Why Did My Crown Castle Lease Revenue Share Payments Go Up or Down?

A number of our clients have ground leases with Crown Castle that contain revenue sharing clauses. They contacted us recently to ask why their lease payments went down or up. Typically, the rent payment adjustments are being made because of what Crown Castle is referring to as adjustments in their master lease agreements with their wireless tenants.

What Is a Master Lease Agreement?

For those of you not familiar with a master lease agreement or MLA, it is an agreement between Crown Castle and a wireless company like AT&T or Verizon where the overall conditions and terms are addressed for all future leases between the two companies. The MLA typically contains the length of the agreement and normal boilerplate language that will be inserted in all the tower company/wireless company agreements. Then, as the carrier needs to lease a new site, a site lease amendment or site license agreement (SLA) is generated that has site-specific details. In some cases, the MLA will contain the specific lease rates for all sites to be leased. In other cases, each SLA will have a specific lease rate.

What Is a Ground Lease Revenue Share Payment?

This matters to landowners who have leases with a revenue share because the landowner typically receives a percentage of the revenue being paid by the wireless carrier to Crown Castle. For example, if the landowner has a revenue share clause of 20%, they will receive 20% of whatever Crown Castle is being paid by the wireless companies on the tower. The revenue share normally does not apply to the anchor tenant and only applies to wireless carriers who sublease space on the tower after the first anchor tenant. If AT&T pays Crown Castle $2000/mo, the landowner would get $400/mo. However, if Crown Castle and AT&T negotiate a new agreement at $1500/mo., the landowner’s “share” would decrease to $300/mo. That is why they call it a revenue share.

In most cases, the rent that Crown Castle receives increases and, therefore, so does the share of the rent being paid to the landowner. However, in October 2018, landowners have been receiving notices indicating that the rent being paid to Crown Castle has decreased. How much? It varies. You might be asking yourself why Crown Castle would be agreeing to lower rent? Are they trying to avoid the revenue share requirement? Perhaps, but there are other reasons why Crown Castle would be interested in reducing the rent they receive.

Why Would Crown Castle Agree to Lower Rent?

First, it is quite possible that Crown Castle is seeking to level out their rents for a specific wireless carrier across all their towers. Some rents might go down, but some might go up. Rents that go down help Crown Castle make it less justifiable for that wireless carrier to relocate to another tower being built by a Crown Castle competitor. (See our previous article on how AT&T and Verizon are desperate to strike back at the tower companies) Secondly, Crown Castle may also have gained other concessions like higher escalation to their lease with the carrier or an agreement by the carrier not to terminate their sublease agreements for a fixed amount of time. Third, it is likely that Crown Castle carefully studied their revenue share obligations before agreeing to a revised amount to see whether they were net negative or positive in terms of income due to the adjustment. Lastly, and this may be specific to only Crown Castle, this could be part of an integrated master lease agreement for macrocells (towers) and small cells where collectively the overall income to Crown Castle increased.

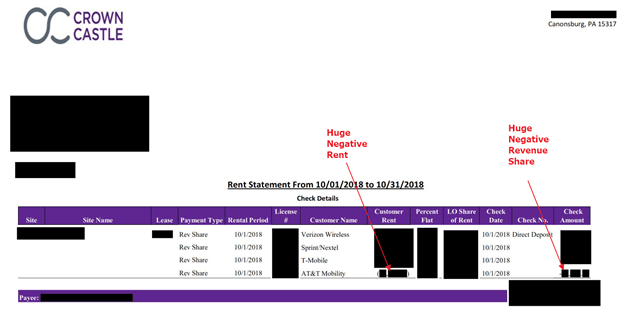

Some landowners have lost income as a result of the sublease rent adjustment. Some will gain. It appears, though, that Crown Castle is retroactively applying the revenue share adjustment for past months. This is likely because the master lease agreement amendments were completed earlier this year and Crown Castle is now just getting to the point of adjusting the revenue share payments. To catch up with their overpayment or underpayment over the last five to seven months, they are adjusting the current revenue share accordingly. This can result in significant swings. One landowner we know of received a NEGATIVE five-figure revenue share, which essentially means that Crown Castle is asking for tens of thousands of dollars back because of alleged overpayments over the last five to seven months.

What Can I Do About It?

Unfortunately, Crown Castle hasn’t been too transparent about the changes or how they arrived at the revised revenue share amounts. If you have received an adjustment to the revenue share calculation in your check, we recommend that you ask Crown Castle for a business summary affidavit (BSA). If your lease requires that Crown Castle share copies of the sublease agreements they have in place with their tenants, ask for those instead. Don’t be afraid to ask for a specific accounting of how Crown Castle calculated the changes in rent. We aren’t suggesting that Crown Castle is intentionally trying to cheat you, just that we have found mistakes previously in their revenue share calculations that were both positive and negative to the landowner.

If you have lost revenue and aren’t sure what to make of it, please reach out to us. We can review your rent statement from the last three to six months and see why your rent went up or down. We can compare it to what our other clients are receiving due to their revenue share clause from that same carrier. If we think the calculations look correct, we will tell you that and won’t charge you anything. If we think there is something wrong with the calculations, we can then talk further about helping you work through sending a formal notice to Crown Castle of the discrepancy.