Cell Tower Lease Rates, Location & Sales Database

In 1997, we began compiling tower location data from public and private lists across the country. We started with the FCC Antenna Structure Registration Database which can be found on the FCC.gov website. In reviewing the data in the FCC ASR, we found that the FCC did not require the registration of many cell towers, nor did it require the registration of individual cell sites on towers or rooftops or other structures like water towers.

Contact Us

As a result, we started looking for tower data from many other sources. We pulled all the public tower company databases (which are no longer publicly available), queried smaller tower companies for their data, and started making public records requests for data. We tracked specific tower related news articles and logged the location and lease rate data from the articles.

When we started Steel in the Air in 2004, we also began tracking the location and information regarding every tower or lease that our clients or leads told us about. Flash forward 12 years and we now have one of the most comprehensive tower location databases in the country and have better and more accurate and complete lease rate data than any other consultant in the U.S. Before we continue, we need to acknowledge now that we don’t sell access to our tower location database or our lease rate data. We use the data to assist our clients who are comprised of tower companies, landowners, public entities, and everyone in between. The only way to receive access to our data is to retain us on a consulting basis.

Cell Tower Lease Rate Database

Ken Schmidt, President

Our Cell Tower Lease Rates Database Includes The Following Information:

- Initial (proposed) and Final (negotiated) Rent (between property owner and wireless carrier or tower company)

- Collocation Lease Rate – if any (between wireless carrier(s) and tower company)

- Escalation Rates

- Term Remaining (Number of Years Remaining on Lease until Expiration)

- Revenue Sharing Metrics – if any

- Termination Rights in Lease for lessor and lessee

- Lease Buyout Offers – if any

Our Clients Use This Data As Follows:

We assist local governments with engineering reviews, zoning regulations, and infrastructure deployment plans. Independent tower owners rely upon our robust data points to perform competitive analyses on prospective acquisitions or new builds. Fiber companies utilize our services to network with companies who are in need of backhaul and network engineering services. Our landowner clients use this data to confirm whether there are nearby towers that may impact the future value of their particular tower or ground lease.

Cell Tower Location Database

Other providers of cell tower location data boast about the quantity of data they’ve amassed. They will throw out figures like “300,000 or 400,000 cell site locations” (despite the fact that there aren’t yet 400,000 cell sites in the U.S.). While we have over 500,000 datapoints in our database, only 200,000 of them are tower sites. The remainder are collocations on those towers or may be duplicative data or data that is simply less reliable. At Steel in the Air, we take pride in our corporate reputation. While we can’t promise that every existent cell tower will be accounted for, we do go to great lengths to ensure that our database lists only cell site locations that are in-use. We can also query our Tower Location Database to pull results for operational cell sites that are located at other buildings or structures, as well as potential buildings or structures that could be used for future infrastructure deployment.

Our Tower Location Database Includes The Following Inputs:

- Cell Tower/Cell Site Location Coordinates (latitude and longitude coordinates)

- Cell Tower/Cell Site Type

- FCC Identification Numbers

- Tower Owner Site Number

- Height of the Structure (Above Ground Level)

- Ground Elevation

- Tower Type

- Original and Current Owner(s) of the Tower/ Structure

- Current Tenants Operating at the Site

- Size of the Compound

Our Clients Use Our Tower Valuation Data For The Following Purposes:

Litigation/expert Witness Requests

Eminent Domain Requests

Tax, Estate, Or Trust Valuations

Cell Tower Valuation & Sales Database

Our Tower Sales Database is not only comprehensive, but reliable. We update it daily and are proud to say that no other independent cellular consultants have access to data that is as robust as ours. In addition to serving our core client base of cellular leaseholders, together with our partner, SteelTree Partners, we’ve helped clients broker over $1.2 billion worth of tower sales representing over 150 transactions. While we don’t sell this data either, we have been retained on a regular basis as experts on tower valuation issues.

Unlike real estate transactions, tower sales and location data are not available to the public via the assessors’ office. This is because tower sales typically occur on leased property, which is considered to be “personal” and therefore private. In addition, tower companies don’t report the actual figures involved in their cell tower sales and purchases. While they might report some general information, it’s not truly “comparable” to most valuation issues unless you are trying to determine the value of a tower portfolio consisting of a few thousand towers.

Our Tower And Sales Valuation Inputs Include:

- Geographic Location of Tower (rural/suburban/urban morphology)

- Sellers of Towers

- Buyers of Towers

- Number of Tenants and Leases per Tower

- Quality of Tenants and Leases per Tower

- Capacity Remaining (Future Tenant Demand)

- Tower Cash Flow (revenue minus expenses)

- Purchase Price for Tower or Portfolio

- Purchase Price Per Tower

Some Lease Buyout Data Inputs Include:

- The Company that made the Lease Buyout Offer

- The Initial vs. Final Negotiated Lease Buyout Offer

- The Offer Purchase Term (over how long the payments will be paid)

- The Multiple of Monthly Rent (a calculation derived by comparing the Lease Rate to the Lease Buyout Offer for comparable Leases)

- The Number of Wireless Tenants on the Leased Structure

- A Difficulty Metric (regarding replacement of the tower)

- Any Revenue Share offers

Cell Tower Lease Buyouts

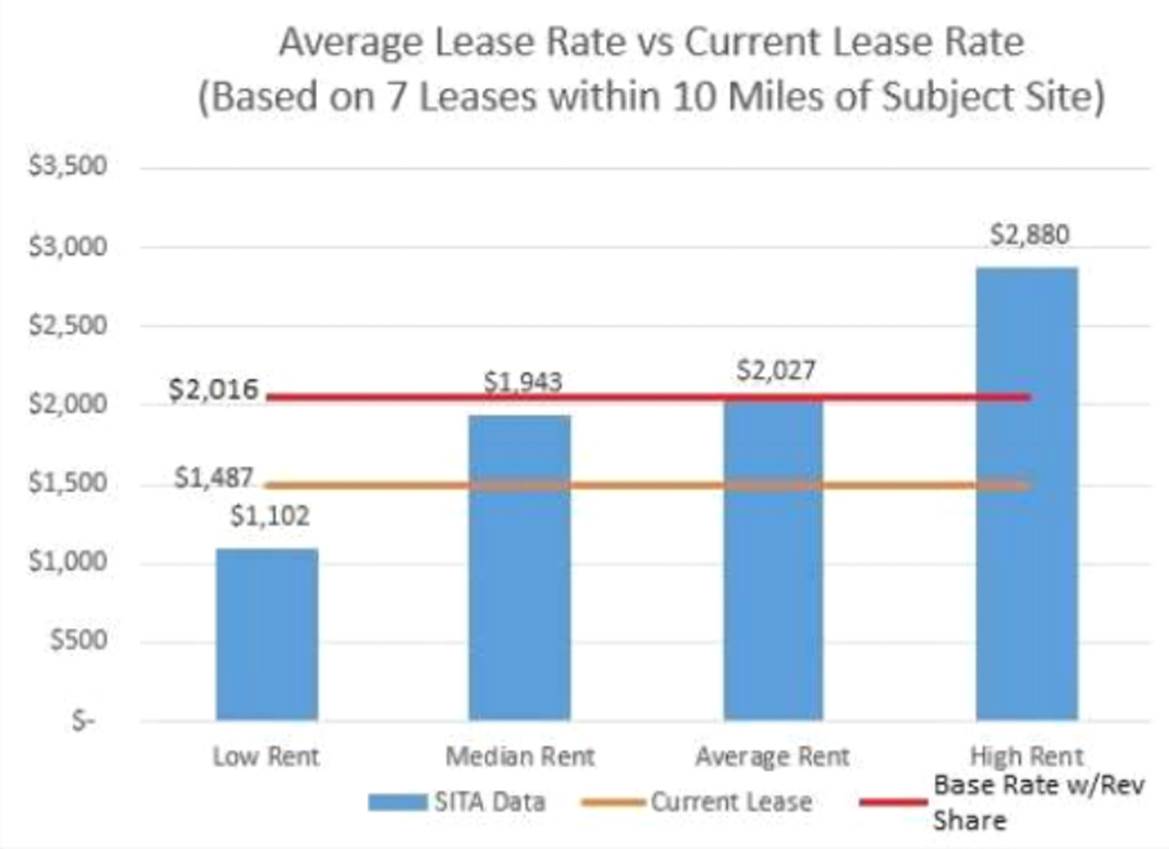

Our clients retain us to help them review and determine the fair market value of their leases whether for a lease buyout or a lease extension. We can also tell our clients very specifically what the average lease rate is for towers in their area. See below for a snapshot of how we present this data to our clients in our consulting reports.

Our Data Is Credible.

Steel in the Air has amassed more data by tracking more nationwide cellular lease rates, tower locations, lease buyouts, and tower sales than any other independent lease consultant in the country.

We’ve been collecting lease rate and tower location data for more than 15 years and we spend over $50,000 each year maintaining and updating our database.

Our Data Is Comprehensive.

Our 3,000+ client base has contributed information on over 10,000 nationwide cellular leases. Additionally, we actively poll public entities (cities, counties, and public utilities) to track their wireless lease negotiations, and cross-check these data points with public sources, such as the FCC, to ensure that all variables are accurate and up to date.

Our Database Is Proprietary And Your Information Is Confidential.

SITA data is 100% proprietary. Our data is used to justify valuation recommendations for our clients and is never sold outright.

Our Data Is Effective.

In addition to serving private landowners, venue owners, and municipalities, Steel in the Air is regularly retained by appraisers and portfolio managers to assist with the valuation of specific leases, cell sites, and cell towers.

We are known to be industry experts who understand the intricacies of the highly vested, federally protected Wireless Communications Industry. We are happy to educate our clients on complex market dynamics affecting any transaction.

Through our partnership with SteelTree Partners, we have brokered over $1 billion in tower sales during the past ten years.

How We Present Our Data To Our Clients.

Steel in the Air incorporates an innovative GIS Tower Mapping app that integrates with Mapinfo, Google Earth, and Bing Maps to provide visual access to any of the 285,000+ towers in our database. Our GIS Tower Mapping app is used in conjunction with our proprietary Cellular Lease, Location, and Sales Database to depict existing cell sites across the nation (on towers, buildings, and other structures). Our final Assessments include visual representations, such as Topographical Aerial Maps and Proprietary Competing Cell Site Maps. Please contact SITA for details.