Desperate to Get Back at the Tower Companies: The Verizon, AT&T, and Tillman Infrastructure JV

Yesterday, in a surprise press release by Verizon, Verizon indicated that it had formed a joint venture with AT&T and Tillman Infrastructure to develop “hundreds” of communication towers with “the potential for significantly more new site locations in the future”. Tillman Infrastructure is relatively new to the US- but owns a few thousand towers in Asia. The press release further states that “These new structures will add to the overall communications infrastructure in the US, and will fulfill the need for new locations where towers do not exist today. They also will serve as opportunities for the carriers to relocate equipment from current towers.”

“WHERE TOWERS DO NOT EXIST TODAY” – REALLY?

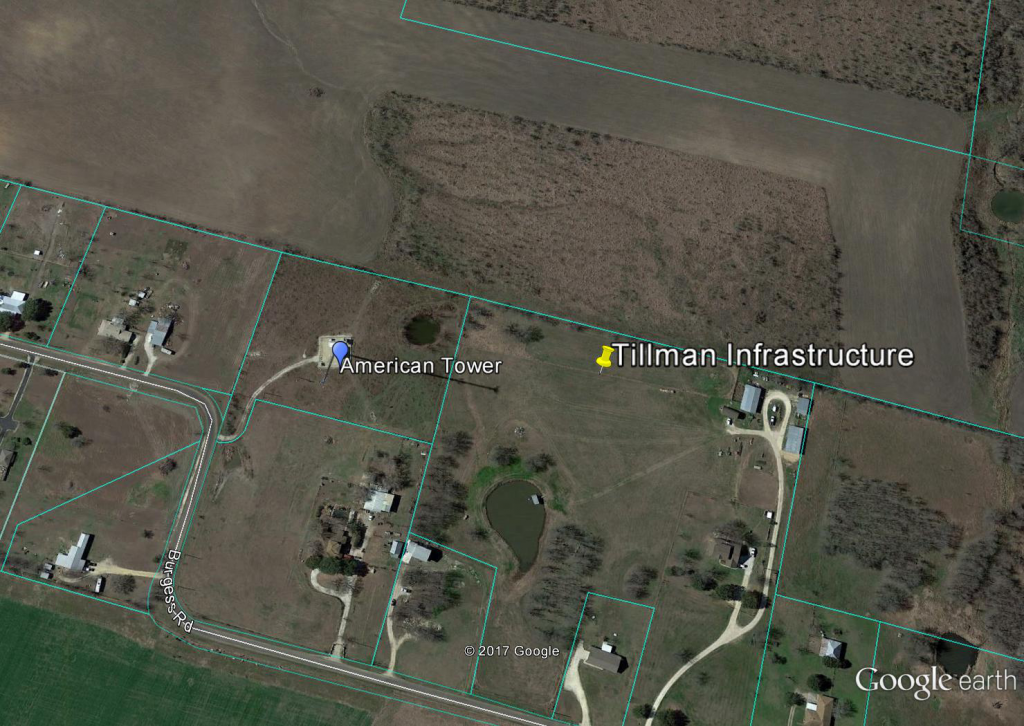

Our landowner clients have been contacted by Tillman Infrastructure for placement of new towers on their property. However, despite Tillman’s claim to the contrary that the towers will be built where towers do not exist today, virtually all of the proposed Tillman towers we are seeing or hearing of appear to be near existing cell towers. In other words, Tillman is building new towers right near existing public towerco towers because AT&T appears to be unwilling to continue paying the higher rent that they are paying on an existing tower. The requests that we have seen are primarily in rural areas, presumably where ground rent will be cheaper and where there is no zoning to prevent the proliferation of towers as being proposed by Tillman. (How do we know? Because we maintain a comprehensive tower location and lease rate database and can easily look up the location of other nearby towers and in many cases identify specific tenants on those towers.)

VERIZON ENTERS THE FRAY

The first interesting aspect of the press release is not that Tillman is out building collocation replacement towers for AT&T on a build-to-suit basis, but that Verizon issued the press release. This strikes us as a clear attempt by Verizon to enter a fray between the tower companies and the carriers where historically their public opposition has been muted. We have already noted Verizon’s reluctance to collocate on public tower company towers in the past- this is another option. However, we suspect that there isn’t much of a commitment on Verizon’s behalf other than that they will consider relocating to new towers from existing towers where Tillman can make them a much better offer than what they are paying already on the existing tower. To us, this press release suggests that neither Verizon nor AT&T has been successful at convincing the public tower companies to adjust their Master Lease Agreements (MLAs) significantly and that both companies are now trying publicly (desperately?) to damage the public tower companies by trying to impact their market valuation. (SBAC dropped slightly yesterday while AMT and CCI were both relatively unimpacted.) We suspect that previous negative comments by all the carriers during previous industry conferences and during earnings calls have been ineffective at changing deal terms in the MLAs and investors were not treating the threats seriously because the economics of building a single tenant tower on inferior build-to-suit terms are poor. However, if both Verizon and AT&T are willing to move from an exisitng tower, suddenly the economics for the proposed tower become more attractive to the build-to-suit partner.

ONLY A FEW HUNDREDS TOWERS?

The second interesting impact of this note is that it specifically calls out that the agreement is for a few hundred towers. We struggle to understand why any of the three companies (except Tillman) would want the investment community to know that it is only a few hundred towers that are being considered currently. While there is a veiled suggestion that it could be more, this press release would have potentially had more impact on investors had it been silent on the number of towers being considered. A few hundred towers is a drop in the bucket for any of the public tower companies.

Clearly there are benefits to AT&T and Verizon of relocating. Not only do they save rent, but they also avoid costly modification upgrade fees and possible structural modification Capex on the existing tower to accomodate additional equipment. With FirstNet on its way, AT&T likely sees this as an alternative to dealing with the tower companies.

If you are a landowner who has been contacted by Tillman for a tower on your property, please contact us and we can help you evaluate their offer and whether you have room to negotiate and if so, by how much. We will review whether there is an existing tower in the area and if so, whether there are other properties besides your that Tillman can select. Please note that Tillman has advised our clients that if they get a consultant involved with negotiating the lease, that Tillman will take their tower elsewhere- so don’t tell them we are involved. There may be a time where it makes sense to do so though, at which point, we will advise you to tell them.

If you are an investor who wants to know more about specific areas of focus for Tillman, estimates of how many sites Tillman is pursuing, and which tower companies seem to be targeted more than others, please reach out to set up a paid research call. We can also intelligently discuss the financial justification for moving and what amount of rent savings justifies relocation. We can also discuss how the public tower companies will combat these efforts and when they will be effective and when they won’t. Lastly, Tillman isn’t the only company focused on collocation relocation build to suit efforts – its just the first one that has gone public with its endeavor.

1 thought on “Desperate to Get Back at the Tower Companies: The Verizon, AT&T, and Tillman Infrastructure JV”

I am going to have ten acres i am receiving from my fathers estate and it is in a area low signal.Area is in highest elevation in State of Pennsylvania.Contact Henry Gent111 if interested.814 4322181. Thank you