What Makes Cell Towers Competitive?

Recently, Fierce Wireless ran an article about AT&T’s threat to public tower companies about how “successful” their tower development project with Tillman Infrastructure has been. The article cites a Morgan Stanley report which claims that “On a national basis in a 0.5-mile radius, ~65% of towers have no competitor and just ~15% have more than one competitor. Within a 1-mile radius, ~45% of sites nationally have no competitor and just ~35% have more than one competitor.”

A tower is considered competing when it fulfils the same coverage or capacity goals or both as another nearby tower. Because coverage and capacity goals can vary widely depending upon the terrain, population density and distribution, time of day, difficulty of zoning, and proximity of other existing sites, there is no uniform distance where a tower would be considered as competing with another tower. We regularly assist our tower company clients with evaluating prospective acquisitions to determine how many competing towers are present across the portfolio of target towers. A tower is considered competing if it falls within the same search area or search ring as another tower. It’s not hard to see that the AMT and CCI towers in the photo above are competitive.

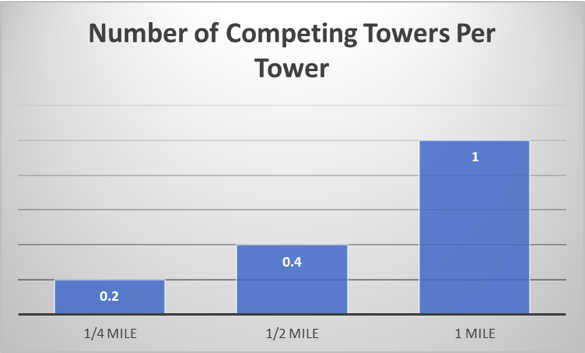

However, when looking at large numbers of towers, it isn’t feasible to look at each set of towers and we must make assumptions. As a rule of thumb, we tend to use the following distances for urban, suburban, and rural areas- ¼, ½, and 1 mile. In other words, if a tower is located within ¼ mile of another tower in an urban area, it could compete for the same prospective tenant. Of course, there are situations where that distance could be less or greater. For ease of analysis though, we utilize these distances.

For example, we previously completed an analysis of our proprietary tower data for a large hedge fund. Specifically, we examined each of the public tower companies’ tower datasets and compared to our own tower data. We looked separately at each large public tower company’s exposure to competitive towers in urban, suburban, and rural areas based upon multiple radii. We chose to use urban/suburban/rural designations instead of BTAs. While BTAs are used by the public tower companies as a proxy for urban/suburban/rural, we find that is misleading as BTAs can include urban and suburban and sometimes rural sub-areas in the same BTA.

We also examined each public tower company portfolio individually so that we could see which company was better positioned for rural expansion, urban infill and densification, and suburban expansion and densification. We also looked to see on average how many competing towers each tower company’s urban, suburban and rural towers had within a distance where a wireless carrier could choose one or the other tower.

We found that on average the public tower companies have .2 competing towers for each of their towers within ¼ mile, .4 competing towers within ½ mile, and just over 1 competing tower within 1 mile on a nationwide basis.

Please note that this doesn’t directly contradict Morgan Stanley’s findings as our methodology looks at average number of competing towers per tower while theirs appears to look at the number of towers with any competing towers within a given distance.

Interestingly, the public tower companies have different levels of exposure to competing towers depending upon whether their towers are in urban/suburban/rural areas with some tower companies having more exposure in rural areas and less in urban areas and vice versa. When you examine how each tower company acquired or built their towers, this stands to reason. SBA chose to acquire towers from other tower companies while Crown Castle and American Tower acquired large chunks of their portfolios from wireless carriers and tower companies.

The tower companies have differing exposure to competing towers depending upon where and how they acquired their towers.

Another point of interest is that there are more competing towers within the assumed “competitive” radii than there were 10 years ago across urban, suburban, and rural towers although this is more pronounced in urban areas as should be expected. We examined the number of competing towers in 2007, 2011, and 2017, and found that the number of competing towers had increased between 25% and 50% between 2007 and 2017. This despite more difficult zoning regulations in many areas that would prevent new towers near existing towers.

Our next near-term project will be using this previous analysis to evaluate how many new towers have been proposed or built near existing tower company towers to date- not just by Tillman but by other build-to-relocate (or BTR) developers as well. If you recall from previous articles, some wireless carriers have simply told any tower company that would listen where they would like to move off an existing tower, with the first tower company to have a tower standing being the one they would lease from.

If you are interested in discussing or purchasing any of our findings, please contact us.

1 thought on “What Makes Cell Towers Competitive?”

Very interesting.