T-Mobile Sprint Merger Backup Plan?

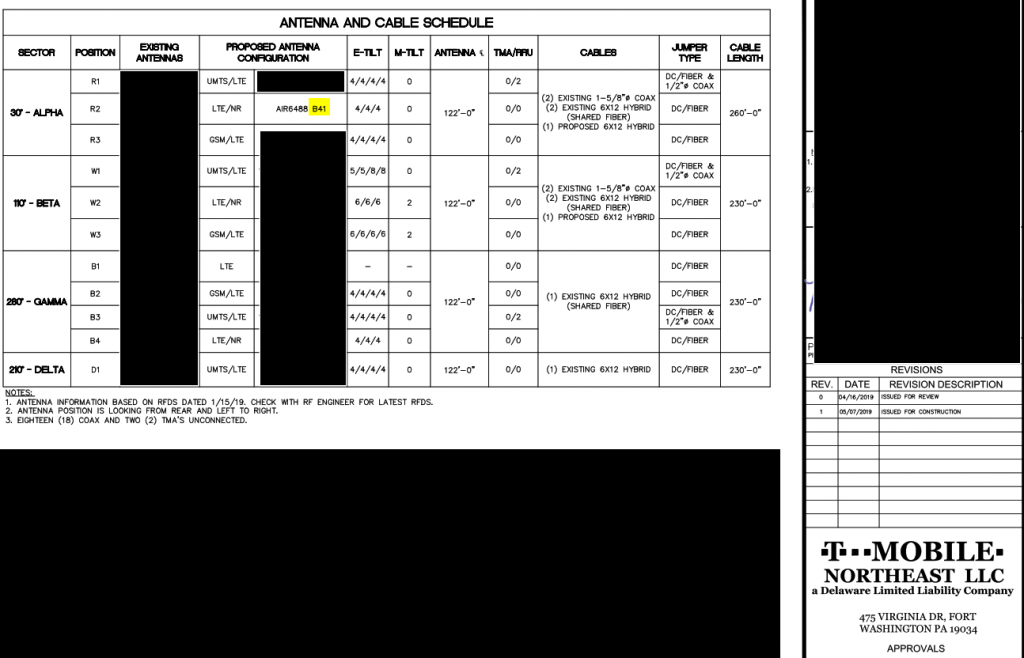

One of our municipal clients has a water tower with T-Mobile and Sprint on it. T-Mobile has proposed to add antennas and equipment with Band 41 (Clearwire 2500 MHz spectrum) to T-Mobile’s rad center. See the image below with the antennas that service B41. Because the lease the client has with T-Mobile prevents the addition of new antennas, they are required to get an amendment. T-Mobile is seeking to have the amendment signed prior to the merger confirmation.

For us, it is difficult to price the amendment because the lease does not allow restriction of equipment based upon the specific frequency, but only on the size, weight, and the number of the antennas. Thus, if the merger occurs, we can make it more difficult for T-Mobile to merge the equipment and terminate the Sprint lease, but not impossible. However, if the merger does not occur, if the client signs an amendment that could allow Sprint to terminate their lease regardless of what happens with the merger.

When we inquired with the T-Mobile agent about making the amendment contingent upon the merger happening or not, we were told that T-Mobile’s legal department would never agree to such a limitation.

Is there a backup plan like spectrum sharing?

T-Mobile’s desire to sign the amendment but unwillingness to make it contingent upon the merger makes me wonder whether there is an alternative plan in the works in the event that the merger is not consummated. This could be a spectrum sharing agreement. This isn’t unprecedented- see this article. But in that case, the spectrum to be shared was PCS spectrum (1900 MHz), not Clearwire’s spectrum (2500 MHz). Thus, the existing agreement would need to be revised or a new one entered into.

Sprint has the spectrum but is a dead company walking without additional capex to deploy 5G. Over time, the distinction between those who invest in 5G specifically in densifying their network will prove greater than that with LTE and 4G. T-Mobile desperately needs mid-band spectrum as running 5G on 600 MHz will be sufficient in areas where there isn’t a significant amount of traffic but will limit their overall network performance elsewhere.

So What to Do?

First, off, it is hard to generalize a course of action that works for every site. Each situation will be different and tied to the specific lease language and exhibits. In this case, the easy but ultimately unfruitful answer is to either reject the request altogether or ask that the amendment rent match that which would be lost with a Sprint lease termination. T-Mobile won’t agree to the latter option so the only option we see is waiting until there is further clarification on the merger . The lawsuit filed yesterday by 10 states against the merger may delay the process and certainly makes the merger probability less certain.

We are curious about what others have done or will do in a similar situation. If you have successfully negotiated through this issue, please either leave a comment here or contact us or private message us if you don’t care to take it public.

2 thoughts on “T-Mobile Sprint Merger Backup Plan?”

I have on tower with Sprint on it and 30′ away have another tower with T-Mobile and ATT does not appear to have been upgraded. It looks like the Sprint tower has been upgraded while the adjoining tower containing T-Mobile and ATT the T-Mobile apparatus has not been upgraded. I’d obviously like to keep both towers active. Since the T-Mobile apparatus on the tower also containing ATT has NOT been upgraded, do you think Sprint will remain active on the tower on which it is currently active if the merger goes thru and T-Mobile will be de-activated on the other tower that also has AT?

Harold, without looking at both towers and the equipment, it is hard to guess which will be kept although we suspect that in most cases, it will be the T-Mobile facility that will be kept. One factor that may weigh into the decision would be who owns the towers now as there may be master lease commitments between Sprint and the tower owner.