Comcast Wireless 2.0: This time it could actually work.

Implications for TowerCos and Construction Companies

Tickers: CMCSA, COMM, MTZ, DY, CCI, AMT, SBAC

Tags: Ken Schmidt, Wireless infrastructure

Background:

Analysts have been speculating about the winners of the FCC spectrum auction and the implications of those wins for the better part of a year. With the auction coming to a close and an announcement expected in the coming weeks, we took a look at the implications of Comcast’s (Nasdaq: CMCSA) expected entry into the wireless market.

On 4/6/2017, Comcast announced their Xfinity Wireless plans. Much has been written on the details of those plans so we will not rehash them here other than to say that Comcast doesn’t appear to be building its own network and that the plans are primarily intended to prevent Comcast customers from churning to AT&T or Verizon.

Timing:

The FCC’s broadcast incentive auction was finalized on March 30, 2017. The FCC is expected to publicly announce the winning bidders sometime in the latter half of April.

Expectations:

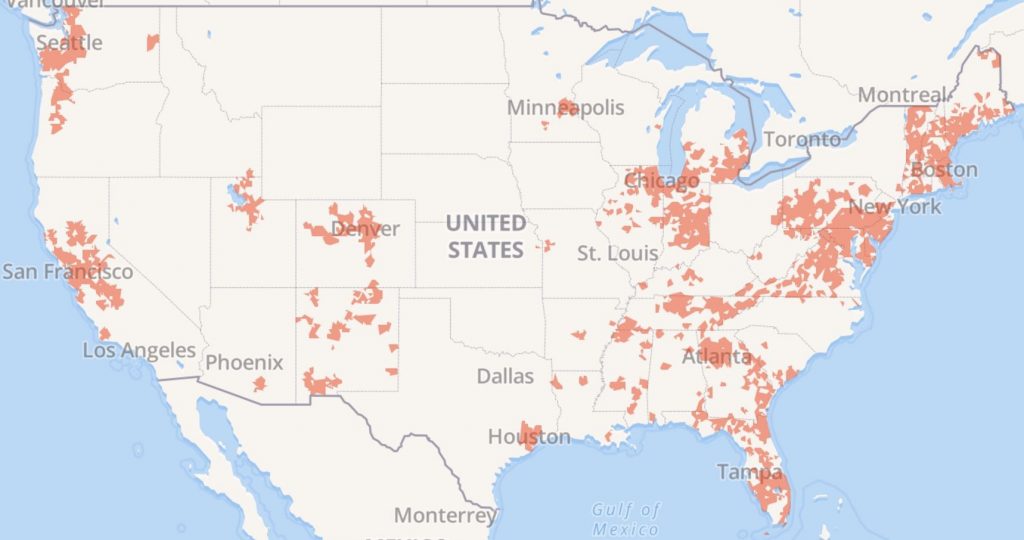

We expect that Comcast bid on and will win spectrum in the auction. CMCSA’s Q3 2016 cash flow statement, which was released publicly on Oct. 26, 2016, includes a $1.8B line item listed as a “deposit”; presumably an auction deposit by CMCSA to the FCC. Some analysts have suggested that CMCSA plans to acquire 30MHz of spectrum on a nationwide basis. We believe that the more likely scenario is that CMCSA will win at least 10MHz of 600MHz spectrum in areas where CMCSA already has fiber/coax infrastructure, as shown on the map below. Alternatively, if CMCSA does win nationwide licenses, we believe they will focus any buildout of equipment in just their current markets they serve now, at least until a compelling business case is developed otherwise.

Source: www.cabletv.com/xfinity/availability-map

CMCSA’s Likely Strategy:

If we are correct and CMCSA wins spectrum in existing service areas, Comcast will use this spectrum to provide both mobile and fixed wireless services primarily to augment their cable services and reduce churn from wireless service providers’ forays into OTT video. We see their plans as an extension of the recently announced Xfinity Wireless strategy.

Buildout Details:

We anticipate that CMCSA will utilize a combination of WIFI and unlicensed spectrum to provide indoor and outdoor coverage and capacity, while using 600 MHz licensed spectrum for wide area coverage. This will enable CMCSA to reduce payments to Verizon under their MVNO relationship and allow them to provide mobile video to customers without incurring per GB charges from Verizon which are reputed to be in the range of $7/GB.

Competitive Dynamics:

CMCSA’s product won’t attempt to compete with either Verizon or AT&T in terms of breadth of coverage. However, its product will be attractive to existing CMCSA cable subscribers who aren’t highly mobile and who don’t require 20GB or more of data. CMCSA’s Xfinity Wireless is set at a competitive price point, particularly to existing customers via a “quad” package.

Marginal Positives for Infrastructure Players:

Companies like COMM, MTZ, and DY should benefit marginally from increased need for CMCSA fiber and coax to the premise to accommodate additional bandwidth (inside and outside the premise). However, near-term expectations should be tempered as broadcasters have up to 39 months to relinquish the spectrum.

Implications for the TowerCos:

The impact on TowerCos should be muted for two reasons. First, broadcasters have up to 39 months to “repack” and return the spectrum to the winning bidders, so any tower lease revenue from CMCSA won’t materialize immediately. Secondly, we suspect CMCSA will attempt to control OPEX going forward by limiting the number of collocations on public tower company towers and by emphasizing small cells especially those that are attached on-strand to Comcast’s existing fiber and coaxial cable runs in public right of ways. Ironically, if the Wireless Industry Association is successful in pushing the FCC to override local zoning oversight and fee structures for small cells, they could be enabling competitors to their own constituent wireless carrier and TowerCo members. Nevertheless, there could be a small bump to TowerCos once the FCC announces the auction winners and the winners include entities that don’t currently lease tower space. The possibility of another potential customer could increase investor interest in TowerCos.

Risks and Unknowns:

The risks to this note include:

- CMCSA could be outbid / fail to acquire spectrum

- CMCSA could be acquired by or merge with an entity that owns spectrum already, and therefore would not need to acquire spectrum or build it out

- CMCSA’s near-term WiFi-First/MVNO-second wireless strategy could prove to be unsuccessful and/or discontinued, causing CMCSA to divest this spectrum prior to it being made available from the broadcasters.

Important Disclosures

This report is for informational purposes only and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, instrument or investment product. Our research for this report is based on current information obtained from public sources that we consider reliable, but we do not represent that the research or the report is accurate or complete, and it should not be relied on as such. Opinions and estimates expressed herein constitute judgments as of the date appearing on the report and are subject to change without notice. Any reproduction or other distribution of this material in whole or in part without the prior written consent of Steel in the Air, Inc. is prohibited. Any projections, forecasts, and estimates contained in this report are necessarily speculative in nature and are based upon certain assumptions. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Steel in the Air, Inc. accepts no responsibility for any loss or damage suffered by any person or entity as a result of any such person or entity’s reliance on the information presented.