American Tower Corporation: Tower Profile

American Tower Corporation (ATC) Fundamentals

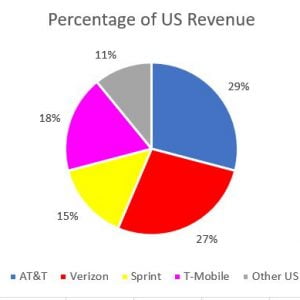

American Tower Corporation is one of the large US and international tower companies. As of mid-2019, they own 40,359 towers in the US along with another 800 “properties” which primarily consist of in-building DAS agreements and some limited ODAS (outside DAS) rights. American Tower Corporation generates revenue by collocating space on its towers to wireless carriers. Overall, 44% of its revenue comes from international carriers and 56% from the US. In the US, this revenue is generated primarily from the big 4 wireless carriers. (International revenue includes passthrough expenses).

American Tower Corp acquired most of their tower portfolio through larger historical acquisitions of Global Tower Partners, Spectrasite, Airtouch (Verizon), Alltel (Verizon), Cingular (AT&T), and Nextel (Sprint). It also builds new towers, leasing land from landowners. To do so, they must contact landowners to enter into what the industry refers to as a ground lease or in the case of acquired towers, assign the lease from the old company to the new company.

Contact Us

American Tower Quick Facts

- From 2nd quarter 2018 through 1st quarter 2019, ATC built 16 towers in the United States while acquiring 204 towers.

- During that same time, they decommissioned 162 towers.

- American Tower has done lease buyouts on just over 13,000 of their towers (33% of all towers in the US).

- 90% of American Tower tower site ground leases are held by landlords who own a single site.

- American Tower has an average term remaining of 28 years on its ground leases.

American Tower Lease Extensions And Buyouts

As of the end of Q1 2019, American Tower had an average of 28 years remaining on average for all its cell tower ground leases in the US which represents a 4-year increase from the same time in 2014 (in other words, American Tower continues to buy or extend its leases). Of the towers ATC owns in the U.S., approximately 90% of them are on property where the property owner only has one tower lease altogether with American Tower. This means that ATC is a party to leases with over 35,000 individual property owners.

Over the last year, American Tower has paid over $154,000,000 to property owners to purchase their leases. This means that American Tower has acquired over 5,000 ground leases from landowners. Typically, American Tower does this by purchasing a long-term easement under the lease from the landowner (see quick fact #3 above).

Why Would American Tower Want To Purchase An Easement Or Extend Your Lease Far In Advance of Its Expiration?

- To get to landowners prior to the landowner retaining an expert who can help them understand the true value proposition in the lease; and

- To prevent the landowner from selling the lease to a third-party lease buyout company

- In the case of a lease buyout, to change the ongoing operating expenditure (Opex) for the lease and convert it to capital expenditure (Capex). This is particularly important for Real Estate Investment Trusts.

Because of substantial, competing interests in ground leases by third-party buyout companies (especially those under tower company towers), ATC has been proactive (and some might say aggressive) in its efforts to acquire or extend its existing ground leases. This often leads the landowner to perceive that they must do something with their lease immediately, even when that’s not the case.

Over the last 15 years, Steel in the Air has assisted over 700 landowners who have been contacted by American Tower Corporation regarding lease proposals, extensions, and buyouts. We have reviewed thousands of proposals from ATC. As part of our day-to-day operations, we track these proposals so that our clients have the benefit of knowing what American Tower offers initially and what they will ultimately agree to. We can bring this experience to bear on your situation and provide actual knowledge of how ATC negotiates and either negotiate or assist you in negotiating your lease with American Tower Corporation.

Our Service Guarantee

Steel in the Air is ethical, transparent, and fully committed to providing excellent service. While we do not work for free (or pretend to), if you have a question and we know the answer off the top of our head, we are happy to share the information with you – as a courtesy and at no charge. However, if something requires research or specific positioning, we will propose a fair rate to you and allow you to choose terms of payment. We can also provide you with the information you need to handle the issue yourself – or if you prefer, we will take charge and work on your behalf to negotiate the results you deserve. We will never pigeonhole you into a situation that is best for our bottom line; our services are much too high-quality for a tactic like that.

After the initial consultation, during which we will offer good faith answers to simple questions, if further review is needed, we will provide a no-commitment quote for services. Our services typically run $2,000 to $5,000 for single tower issues. The more complex the situation, the more we charge to provide services. Each case is as unique as the parcel of land that the site in question is located on. If we think we can help, we will provide a no-obligation quote. Our fees are fixed, meaning that no matter how well you do with improving the lease, our fees stay the same. Other consultants will take 10% of the lease or more going forward, which may not seem like much, but over time can add up to tens of thousands of dollars.

We Help You Review American Tower Proposals

There are five proposals that landowners receive from American Tower:

- American Tower Lease Buyout: ATC offers to purchase the ground rights under their existing tower through a perpetual or fixed-term easement.

- American Tower Ground Lease Extension: ATC proposes to extend their ground lease for 30-50 years. They typically offer a nominal signing bonus and will sometimes offer to increase the rent going forward.

- American Tower Proposed Cell Tower Lease: ATC contacts a landowner to enter into a lease to erect a tower on the property.

- American Tower Rooftop Lease Purchase Offer: ATC has recently formed a Rooftop Lease Buyout division to contact building owners who have rooftops where they lease space to wireless carriers directly. They then propose to acquire the rooftop leases plus the rights to the remaining space on the rooftop so that they can lease to other wireless carriers.

- American Tower Lease Expansion or Consent Requests: ATC will contact their existing landowners to request the right to expand their lease footprint or to receive consent to sublease space on the tower to a wireless provider.

Please contact us to discuss any questions you might have about a proposal you have received from American Tower Corporation. The initial discussion is free and once we talk to you and understand your needs, we can advise you as to what the costs would be should you choose to retain our services. Unlike our competitors, we offer the flexibility of either a fixed-fee consulting service or a contingency-based service.

Insider tips

Wireless carriers and tower companies often send notices to their Lessors (e.g. landowners, building owners and structure owners) stating that the Lessor must consent to certain equipment modifications. This is not necessarily true. In many cases, you can negotiate better terms (or receive some form of compensation) in exchange for your “consent.”

The trend with new cell site leases is to include a “Right of First Refusal” clause. This means that if a third-party were interested in buying your lease you would first have to offer it to the original Lessee. This could substantially lower the final purchase amount. While it might not be possible to avoid the ROFR clause altogether, you might be able to negotiate away from “pro-rata” matching.

We advise our clients to remove the blanket “Right to Sublease” clause from rooftop cell site leases. Contact us for more details.