The Impact of the T-mobile and Sprint Merger on Landowners With Cell Site Leases

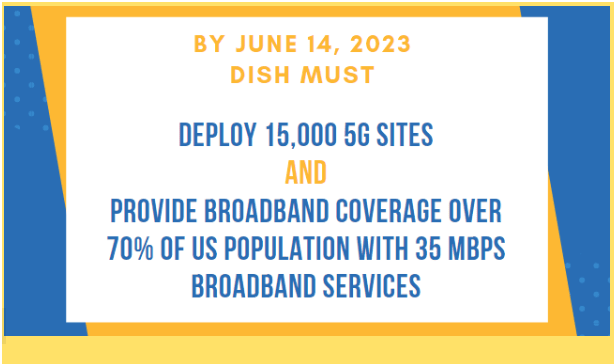

On July 26, 2019, the Department of Justice announced that terms had been reached between the DOJ, Sprint, T-Mobile, and DISH to approve the merger between Sprint and T-Mobile. Divestiture of assets and spectrum from the newly merged company (New T-Mobile) will be made to DISH, which has engaged in reciprocal commitments to build out a nationwide 5G network. For landowners, after two years since the original merger announcement, the wait is over because of a lawsuit brought by 13 states block the merger of the two companies as being anti-competitive.The judge ruled in favor of T-Mobile and Sprint and the merger is expected to occur by the end of February,

Better Result Than the FCC Was Prepared to Approve

Contact Us

1. The primary concern by the DOJ was that the market was not as competitive with just three wireless providers. By requiring divestitures and commitments by DISH, the industry still has four national wireless providers

3. Requires New T-Mobile to offer all sites (minimum of 20,000) that it intends to decommission as a result of the merger to DISH within 5 years. If you recall, as part of the original announcement of the merger, T-Mobile indicated that upwards of 35,000 sites would be eventually decommissioned. DISH is not obligated to take any of these sites but will almost assuredly need to take some to meet the buildout requirements.

4. Requires Sprint to sell its 800Mhz spectrum to DISH. The good news is that prior to DISH’s involvement, there was little probability that anyone else would take the decommissioned Sprint sites. Now, there is a decent chance that some or many will be kept, especially given that the 800Mhz spectrum is included. It doesn’t make sense for DISH to terminate these leases, build new sites, buy new equipment, and deploy the 800MHz spectrum again. It is possible

in the future that some sites DISH assumes could be terminated later after they replace it with their own location.

What Does This Mean For Cell Site Owners?

T-mobile Lease Holders

Generally, not much has changed. Even before the most recent agreement with DISH and the DOJ, most T-Mobile leases were considered safe. Now that the merger is approved and the overall agreement is clear, if anything, this helps secure T-Mobile leases even further.

Sprint Lease Holders

Tower Company Lease Holders

Landowners Considering Selling Their Leases:

A Rather Large Elephant In The Room

How Can Steel In The Air Help?

If you have a T-Mobile (including Voicestream, Omnipoint, MetroPCS) or Sprint (including Clearwire and Nextel) lease or are approached by DISH, we can provide insight to the merger and how it impacts you. We won’t try to convince you to sell us your site nor will we pitch you services you don’t need. Unlike some of our competitors who are double-dipping by working for buyout companies and you at the same time, we don’t receive compensation from anyone other than you. And unlike our competitors who charge a success fee (typically 15% to 33% of any increase they get you for the entire term of your lease), we charge a flat fee that is clear up front. Whether you end up making $50,000 or $500,000 extra as a result of our involvement, you pay the same flat fee, typically far less than what you would pay as a success fee. If you prefer a success fee, please let us know and we will provide a quote on that basis.

- Review of Lease Extension Offers: The New T-Mobile or DISH may reach out to you to extend their lease with you. We can review their options and help you evaluate the lease extension proposal.

- Review of Modification Requests: With new spectrum (both from DISH and from Sprint), the new T-Mobile will need to make modifications to their existing sites. This may or may not require additional rent. We have the expertise to review the construction drawings and the lease and advise you on how to best respond. Best of all, we will review their proposed equipment and your lease BEFORE you hire us to make sure you will see a high return on your investment in our services.

- Analysis of Proposals to Renegotiate Your Lease:Unfortunately, with this merger will come a flurry of attempts to renegotiate the terms of your lease agreement. T-Mobile has historically retained Black Dot and Md7 to contact landowners indiscriminately to push for a cheaper lease, regardless of whether they have no other choice but to stay. T-Mobile’s agents will allege that if you don’t negotiate, they won’t keep your lease or DISH may not acquire it. We help you understand how your site fits into the merger plans and whether there is a risk if you tell them “no.” If you are contacted by a lease optimization company or T-Mobile directly trying to renegotiate your lease, reach out to us.

- Review of Lease Buyout Offers:Just as there is an increase in attempts to renegotiate the lease, every time there is a merger, lease buyout companies increase the pressure as well. They allege that if you don’t sell now, your lease will be terminated or go down in value. (One has to ask “why they would be interested in buying it then?”). If you are concerned about whether there is a higher risk related to your T-Mobile or Sprint lease due to the merger and are contemplating selling your lease as a result, we can help. We can evaluate your lease and let you know if there is any risk at all. If there is, we can help you decide whether you are better off keeping the lease as is or selling it. And if you decide to sell, we can help you find the best offer or tell you what the lease is worth.

- Review of Termination or Decommission Requests:Unfortunately, some of you reading this page will likely receive a notice that your lease is being terminated. You may receive a request to leave the equipment on your site (hint: it rarely makes sense to do so) or an offer of a one-time payment in exchange for your release of their liability in the lease or at the site. We have been through this with many mergers now – AT&T/Cingular, Sprint/Nextel, Sprint/Clearwire, Verizon/Alltel, T-Mobile/MetroPCS, and AT&T/Cricket, to name some. Steel in the Air has assisted more clients on merger issues than any other firm by a wide margin. We know their tricks and what they are trying to accomplish. It’s unlikely that we can help you save your lease, but we can definitely make sure you don’t add insult to injury by agreeing to an even worse deal.

Insider tips

- If the T-Mobile agent tries to pressure you into making a fast decision, typically their drop-dead dates are not real. Want to make sure? Run it by us.

- Don’t get antsy if nothing happens for a while. The merger isn’t finalized yet and the companies still have a lot to do before they understand what assets to keep, what to divest, and what to decommission.

- If you are contacted with a request to keep the equipment on-site, ask the agent how much they are willing to offer you to do so. If nothing, tell them to remove it.