Sprint’s Network Overhaul- Radical Impact on AMT, CCI, and SBAC?

The website Re/code posted an unconfirmed article on Friday re: Sprint’s Next Generation Network which stated “sources familiar with the initiative said Sprint plans to cut its network costs by relocating its radio equipment from tower space it has leased from Crown Castle and American Tower to spots on government owned properties which costs much less.” The article also alleges that Sprint is attempting to reduce its dependency on AT&T and Verizon’s high-speed fiber optic cables.  Directly after posting this article, shares of American Tower (AMT), Crown Castle (CCI) and SBA Communications (SBAC), were down 3%, 6%, and 8%, respectively, while Sprint dropped 9%.

Directly after posting this article, shares of American Tower (AMT), Crown Castle (CCI) and SBA Communications (SBAC), were down 3%, 6%, and 8%, respectively, while Sprint dropped 9%.

I wanted to write a clarification in response to this, to provide our readers with a more robust analysis of what’s happening behind the curtains. Not only was the article cited above sufficiently bad enough to devalue Sprint, the very fact that it did so was completely unwarranted. It

demonstrates poor inductive reasoning skills to arrive at an erroneous conclusion, stating that Sprint plans on abandoning its existing collocations on American Tower and Crown Castle towers as part of its Next Generation Network buildout. Please note that we don’t own stock or perform services for either tower company and we don’t work for Sprint (but we do have a small holding in S stock). In fact, we regularly assist landowners in negotiating cell tower leases against each of the Big Three Tower Companies and Big Four Wireless Carriers.

Perhaps it is easier to share some facts that we know/have about Sprint’s Next Generation Network, which should enable you to see how these propositions can be improperly evaluated to form a wrong conclusion, such as the one that Re/Code came up with.

WHAT WE KNOW ABOUT SPRINT’S NEXT GENERATION NETWORK

- Sprint has been issuing Requests for Proposals, along with many, many revisions, for its Next Generation Network (NGN) network buildout for almost a year now. Previously, the strategy behind Sprint’s Network Vision network plan was to substantially reduce the amount of equipment at each site by consolidating multiple carriers’ (Sprint, Nextel, and Clearwire) frequencies into one set of equipment. The NGN has been an attempt to densify Sprint’s network using a small number of new macrocell towers, along with a substantial number of mini-macro small cells. Mini-macro cell sites are smaller than traditional cell tower sites, but larger than small cells.

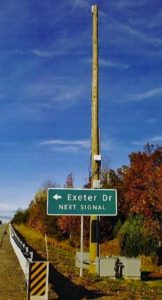

- Sprint has entered into an agreement with Mobilitie to fund and deploy these mini-macro sites, like the one shown here, which was submitted to Salem City, MA on November 6, 2015 (and ultimately rejected by the City). Estimates for the number of mini-macro sites to be deployed are between 50,000 and 70,000. Sprint is uses these mini-macro sites to densify its network and to optimize the high frequency spectrum (2.5GHz) acquired from Clearwire, which requires denser deployment of cell sites in order to be effective. When deployed correctly, the higher frequency spectrum is ideal for handling massive amounts of data traffic.

- Based upon inquiries to our municipal clients, it appears that Mobilitie is targeting government and utility owned property for these mini-macro cell sites.

Other attempts by wireless carriers to deploy small cells on private property have demonstrated that, while the equipment cost for small cells is significantly less than a large macrocell (or tower site), the site acquisition and routing of power and backhaul is comparable to deploying a macrocell. As a result, we have observed a significant increase in the number of requests being made to cities, counties and townships across the country for the lease and use of municipal owned utility structures, or the placement of new structures/ antennas in existing utility rights of way. At this point, we are unaware of any municipalities that have actually completed deployment of mini-macro sites. Mobilitie appears to be testing the market and attempting to enter into franchise agreements and master lease agreements with municipalities prior to buildout.

Other attempts by wireless carriers to deploy small cells on private property have demonstrated that, while the equipment cost for small cells is significantly less than a large macrocell (or tower site), the site acquisition and routing of power and backhaul is comparable to deploying a macrocell. As a result, we have observed a significant increase in the number of requests being made to cities, counties and townships across the country for the lease and use of municipal owned utility structures, or the placement of new structures/ antennas in existing utility rights of way. At this point, we are unaware of any municipalities that have actually completed deployment of mini-macro sites. Mobilitie appears to be testing the market and attempting to enter into franchise agreements and master lease agreements with municipalities prior to buildout. - If Mobilitie and/or Sprint are treated as a utility, in many states they receive the benefit of paying federally regulated pole attachment rates when installing equipment. Furthermore, Mobilitie (and other similar small cell and Distributed Antenna System developers, such as Crown Castle) often attempt to convince local municipalities that they can’t be charged traditional lease rates or franchise fees for new poles. The reason is that the federal pole attachment rates are often pennies on the dollar, as compared to what they would be charged otherwise by these same utilities or municipalities. Furthermore, by using existing poles, small cell providers avoid some but not all of the onerous zoning hurdles that often accompany the erection of new towers.

- We have a few hundred municipal clients across the United States who we advise daily on the appropriate lease rates they should be charging for macrocell tower leases. Lease rates for macrocell towers, cell sites on rooftops, and water towers on governmental property in urban and suburban areas are typically more than 25% above those on commensurate private property. The only places where lease rates are less than private leases are in large federal agencies with large rural land holdings such as the Bureau of Land Management, the National Park Service, and the National Forest Service. However, with those entities, lease negotiations take years and there are substantial environmental hurdles that have to be met before any lease can approved.

- Crown Castle and American Tower have long term tenant leases in place with Sprint.

from Omar Masry’s profile on LinkedIn These leases have on average between 7-8 years remaining before the tenants can terminate. This means that Sprint likely will not (because it cannot) terminate its leases with Crown Castle and American Tower for the next 7-8 years.

- Sprint technically still owns the 6,600 towers they sold to Crown Castle in 2007 (via an intermediary, Global Signal). Crown Castle is subleasing those towers from Sprint under a pre-paid capitalized sublease agreement. Those sites are also subject to a master lease agreement with defined lease rates, which are fairly valued, in our opinion.

- Sprint has on multiple occasions issued Requests for Proposals (RFP) to any tower companies that identify a list of Sprint sites where the ground lease or the collocation lease for the tower or cell site are costly (As have other wireless carriers like AT&T). Sprint requests in the RFP that those tower companies with an interest in building alternative sites/towers next to the problematic sites propose lease terms for Sprint. Sprint would enter into a Build to Suit agreement with the winning tower company(s) and move their equipment from the costly tower to the newly built tower. Historically, these RFPs have resulted in just a very small percentage (>5%) of relocations. More likely, in our opinion, these RFPs are generated specifically to encourage the negotiation of master lease agreements with the large tower companies, and are not intended to result in the actual relocation of a significant number of macrocell towers.

- Sprint wants to use Clearwire spectrum and microwave sites for its backhaul. The 2.5GHz spectrum is effective at transmitting high amounts of data. This would allow Sprint to avoid leasing (to a certain extent) fiber backhaul from AT&T, Verizon, and every other fiber provider that provides dark or lit fiber service to Sprint. It is important to recognize though that eventually the traffic must connect to the landline network, and often this will be done through fiber.

STEEL IN THE AIR’S FORECAST REGARDING SPRINT’S NEXT PLAY

Re/code appears to be inferring, from the limited public information available about the NGN along with information from “an unknown source”, that Sprint’s plan includes the relocation of existing collocations on Crown Castle and American Tower sites en masse to those built by Mobilitie onto government owned properties. We believe that Re/code and/or their sources came to this conclusion erroneously. While it’s true that Mobilitie and Sprint are seeking to develop mini-macros on governmental land and utility structures, they are not going to terminate thousands (or even hundreds) of standing macro cell collocation leases with American Tower and Crown Castle as a result. The mini-macro cells are complementary to the macro cells, and exist underneath and in-between the macrocells, creating what the industry refers to as a Het-Net or heterogeneous network. In a Het-Net, both components are equally critical, since macro cells provide overarching coverage and support a large number of individual users, while the mini-macros are meant to augment and facilitate highly localized data traffic. Consider that it takes 10-30 small cells to replace the coverage of one macrocell. So, to sum up this point, Sprint is not deploying mini-macros in order to terminate its existing macrocell leases; rather, they are deploying them to add capacity to their standing towers. They are certainly targeting governmental properties which are commensurately cheaper in states that have chosen to adhere to federal pole attachment regulations and rates. For those states that haven’t, there isn’t a significant cost advantage.

Sprint and Mobilitie may choose to use small cells/mini-macros to reduce the number of new collocations on existing American Tower, Crown Castle, and SBAC towers in urban and densely populated suburban areas where mini-macros make fiscal sense. However, in rural areas and sparely populated suburban areas, collocations on existing cell towers are too cost efficient and Sprint has and will continue to collocate on such towers. In other words, Sprint’s NGN plan will reduce the number of new inbound collocation leases on macrocell towers, like those owned by Crown Castle and American Tower, but by and far between, this does not justify a wholesale move by Sprint from American Tower and Crown Castle towers to Mobilitie owned and developed macrocell towers on governmental property.

As it pertains to existing collocations on American Tower and Crown Castle towers, Sprint is under master leases with both companies that limit its ability to leave the towers, and it is our strong opinion that Sprint is not that incentivized overall to do so. There will be cases where Sprint (and other carriers) will opportunistically use small cells to reduce their dependence on some of their more expensive leases. However, the cost of relocating from one site to another is substantial ($100,000+), and the burden of getting zoning approval for a new tower near an existing one in most urban and suburban markets is quite cumbersome. Local municipalities push hard against the proliferation of towers, especially when there are standing towers that have enough structural capacity for the intended user of the new tower.

RE/CODE’S FLAWED REASONSING COULD MISLEAD INVESTORS

- There will not be a mass migration from AMT and CCI towers due to Sprint terminating its collocation leases. At worst, there may be opportunistic terminations by Sprint on a few hundred towers as Sprint attempts to demonstrate a show of force in their negotiations on upcoming master leases. However, with 20,000 to 30,000 leases on the public tower company towers, Sprint is still beholden to the public tower companies, whether it wants to be or not.

- Sprint and Mobilitie will continue to build mini-macros on governmental property or utility rights of way. These sites will be cheaper than those built on private property or on the public tower company’s towers. CCI probably has more to lose than AMT or SBAC in this regard due to their substantially bigger interest and investment in small cells. We are seeing specific instances where both CCI and Mobilitie are actively courting our municipal clients in an attempt to gain access to municipal rights of way and structures.

- We wonder whether sources from Sprint planted this story with Re/Code or gave them enough information such that Re/Code’s author jumped to the wrong conclusions. Sprint’s unwillingness to confirm or deny this story is expected. The decrease to the tower company market caps certainly helps Sprint in pending master lease negotiations.

OUR CONCLUSION AND RECOMMENDATIONS

Unless Re/code and its sources can provide more documentation regarding the specifics of this plan, this story by Re/code seems to be more harmful than helpful, and demonstrates what poor inductive reasoning can do. While we aren’t that optimistic that Sprint’s Next Generation Network will reverse Sprint’s fortunes, we also don’t see that the almost 10% drop in value was warranted from Re/code’s unconfirmed reporting. If you were bullish on Sprint before, you should be even more so now.

About the author: Ken Schmidt is the foremost expert in the country on cell tower leases. He is the owner and founder of Steel in the Air, Inc. Steel in the Air assists public and private landowners and structure owners with negotiating cell tower leases.

Other attempts by wireless carriers to deploy small cells on private property have demonstrated that, while the equipment cost for small cells is significantly less than a large macrocell (or tower site), the site acquisition and routing of power and backhaul is comparable to deploying a macrocell. As a result, we have observed a significant increase in the number of requests being made to cities, counties and townships across the country for the lease and use of municipal owned utility structures, or the placement of new structures/ antennas in existing utility rights of way. At this point, we are unaware of any municipalities that have actually completed deployment of mini-macro sites. Mobilitie appears to be testing the market and attempting to enter into franchise agreements and master lease agreements with municipalities prior to buildout.

Other attempts by wireless carriers to deploy small cells on private property have demonstrated that, while the equipment cost for small cells is significantly less than a large macrocell (or tower site), the site acquisition and routing of power and backhaul is comparable to deploying a macrocell. As a result, we have observed a significant increase in the number of requests being made to cities, counties and townships across the country for the lease and use of municipal owned utility structures, or the placement of new structures/ antennas in existing utility rights of way. At this point, we are unaware of any municipalities that have actually completed deployment of mini-macro sites. Mobilitie appears to be testing the market and attempting to enter into franchise agreements and master lease agreements with municipalities prior to buildout.

3 thoughts on “Sprint’s Network Overhaul- Radical Impact on AMT, CCI, and SBAC?”

Hi Ken,

Just wanted to say well done with your expert analysis on the “grossly misinterpreted” information that re/code put out there. Irresponsible at best!

Anyway, I agree with you all the way. In fact after hearing and reading about what re/code said I put in an order in extended hours to add to both my positions in AMT and CCI. They never got filled as they were limit orders…so I’ll see how things open tomorrow and go from there. Incidentally I have both a CCI and AMT tower side by side on my property. So I follow these things pretty closely.

Thanks again,

and..Take Care,

Doug

Ken,

I just wanted to thank you for your article on Sprint, And apologize at the same time for the poor Wall Street Media statements that you had to clear up. Their are Short Sellers that are trying to “eviscerate” Sprint, in a term from Japan ( Hari Kari ) .. for a number of reasons. The level of Stock manipulation on the Short Side of Sprint should but looked into by the SEC. In my opinion, as the Negative Media has taken Control of all the News we see on the Net about Sprint. I can Say this because, if you go to any Financial Quote Service you will see a number of Off Takes from your explanation of the Sprint Situation. None of them come to the same conclusion that your fine information explains.. This is not the American Way.. imo.. Or it wasn’t that way 30 years ago. Greed has taken over the American Exchanges. And it looks like we will have to live with this Greed as they justify it as free enterprise… again imo.. But thanks again for clearing up this mess… eg jr.

As a follow up- on Sprint’s Fiscal 3Q 2015 earnings call, they confirmed that there would not be any near term terminations of tower company collocation leases. They confirmed that they would be using their own spectrum for small cell backhaul along with installation/use of dark fiber.