Leap Wireless News: AT&T Wireless Acquires Leap Wireless (Cricket)

What does this wireless company merger mean to leaseholders?

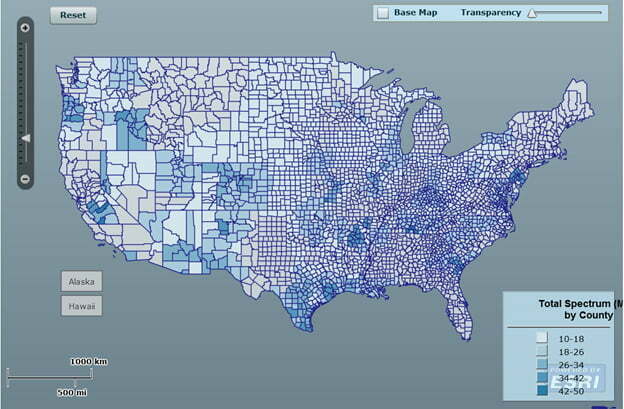

On July 12, 2013, AT&T announced plans to acquire LEAP Wireless (Cricket). AT&T will acquire LEAP for $1.2 billion dollars, however the transaction excludes the 700MHz spectrum that LEAP owns in the Chicago metropolitan area. AT&T will get 23MHz of the spectrum, covering 137,000,000 people in the areas where LEAP Wireless (Cricket) currently has coverage. (See the map below for LEAP’s nation-wide spectrum holdings.)

AT&T’s acquisition of LEAP Wireless is a strategic one in that it:

- Blocks other carriers from acquiring LEAP (Cricket),

- Allows AT&T to compete better in the pre-paid space where Sprint and T-Mobile are causing headaches for AT&T, and

- Allows AT&T to acquire an Advanced Wireless Services (AWS) spectrum that matches their own AWS spectrum in order to develop a better LTE network. Since AWS is already in use on AT&T phones, the fact that LEAP (Cricket) operates a CDMA and LTE network while AT&T operates a GSM and LTE network should have little impact.

LEAP Wireless (Cricket) currently has approximately 9,700 sites across the US, according to Macquarie. AT&T and Cricket lease holders should be asking what impact this merger will have on AT&T and Cricket cell tower leases. Here is what we think could or will happen.

- As it pertains to landowners with AT&T cell tower leases or building owners with AT&T rooftop leases, there will likely be relatively little impact. There may be spot terminations where AT&T has a worse lease or location where AT&T and LEAP Wireless (Cricket) both have sites and they choose to keep the Cricket lease.

- As it pertains to tower owners or rooftop owners who have both AT&T and Cricket leases on their tower or rooftop, it is likely that one of the leases will eventually go away.

- As it pertains to landowners with LEAP (Cricket) cell tower leases or building owners with LEAP (Cricket) rooftop leases where AT&T is not on the subject tower or property, there is increased possibility that AT&T and LEAP Wireless (Cricket) could eventually terminate the lease. It will take some time for the merger to be consummated (likely mid- 2014) and then some additional time for AT&T’s engineers to determine what they need for their network going forward and what they don’t. For tower owners, there could be some amendments required due to this merger, especially if they have frequency limitations in their leases.

- As it pertains to leaseholders who have been considering or have already entered into a cell tower lease buyout agreement and who have AT&T or Cricket leases, there may be some efforts by the lease buyout companies to re-trade the deal or they may simply choose not to purchase the Cricket lease(s).

If you have an AT&T or a LEAP Wireless (Cricket) lease and are concerned about what may happen, please contact us. We can review your situation, keep you apprised on how the wireless industry is viewing this situation, determine whether AT&T and Cricket both have nearby sites, assess whether your lease(s) are at risk, and advise you on the best course of action regarding your leases.