Most Influential Events in 2014

1. Sprint/ T-Mobile Deal Collapse

In May 2014, Sprint formalized its intent to acquire T-Mobile from Deutsche Telecom. If the union had met with approval from the FCC, the new entity (with a combined total of ~108 million subscribers) would have effectively rivaled both Verizon (~118 million) and AT&T (~108 million subscribers). For a brief amount of time this past summer, it was looking as though a marriage between the #3 and #4 carriers might, in fact, be blessed by the FCC, but that was before regulators denied Sprint and T-Mobile the opportunity to bid as partners in the spectrum auctions. In July, Sprint called off their attempted efforts to merge with T-Mobile when it seemed clear that they would not gain approval from the FCC and Department of Justice. Landowners with either T-Mobile or Sprint leases were happy as it meant that there was substantially less likelihood that either company’s leases would be terminated due to redundancy between their networks.

2. Revised FCC Order on Shot Clock

The FCC’s October 2014 Report and Order on Improving Wireless Siting Policies provided a regulatory framework for local regulatory bodies, such as municipal zoning authorities, to adhere to when dealing with new cell site builds. The Report comes as a response to the wireless industry’s request that the FCC loosen some federal regulatory standards set forth by the National Environmental Policy Act of 1969 and the National Historic Preservation Act of 1966, particularly those regarding DAS and small cell builds. DAS and small cell systems, while technically classified as “wireless facilities” utilize a much smaller footprint than traditional macrocell tower builds. The Report spoke favorably of both small cell and DAS systems, stating that “Because small cells are significantly smaller than traditional macrocells, networks can reuse scarce wireless frequencies, increasing spectral efficiency and data capacity within the network footprint” and “DAS deployments offer robust and broad coverage without creating the visual and physical impacts of macrocells.”

The recent Order will advantageously affect the wireless industry in several ways, in addition to paving the way for more efficient small cell and DAS builds. It will be easier for carriers to receive approval to collocate on operational towers (provided that they comply with zoning and historic preservation conditions). Additionally, the definition of “equipment” has been broadened to include all equipment associated with the operation of the antennas, which will allow technological upgrades to happen with less red tape.

In the first 4-5 months of 2014, SITA received approximately an equal amount of inquiries from landowners who had received cell site lease proposals from AT&T and Verizon. In that same time frame, we saw almost no inquiries from landowners who were approached by Sprint or T-Mobile. Then in late second quarter, landowners who had been approached by AT&T for new towers were being told that their projects had been put on hold. Simultaneously, AT&T announced a two-month freeze on capital expenditures (CapEx) which later turned into a significant reduction throughout the end of 2014.

Why the slowdown? AT&T suggested that it would not invest money in new infrastructure while the FCC pondered whether to characterize AT&T as a utility, thereby subjecting AT&T to a possible “net neutrality” policy. Steel in the Air believes that is just a smoke screen. The real reason behind AT&T halting its network infrastructure roll-out is because it spent, or plans to spend, too much money on acquisitions. In March 2014, AT&T purchased Leap Wireless for $1.2 billion. AT&T announced plans in May 2014 to buy DirectTV, which will cost $48.5 billion, but will give the company access to more than 38 million video subscribers in the U.S. and Latin America. In November, AT&T also announced plans to buy Mexican Telecom Iusacell for $1.7 billion. While it does seem that the company’s divestitures are broadening (particularly into video), the near term result is clear that the company pulled back on its plans to aggressively build out rural areas with new towers.

So what can the cell site lease sector realistically expect from AT&T in 2015? More of what we saw in 2014 – fewer new site builds and a renewed focus on site upgrades and fiber backhaul to existing sites. While the slowdown won’t impact existing site owners, it will delay new AT&T installs on existing towers and reduce the number of landowners who receive proposals for new AT&T ground leases.

T-Mobile, the #4 U.S. wireless carrier in term of subscribers, has been called “The Most Innovative Tech Company of the Year” by CNN. T-Mobile added more than 3.5 million customers in 2014, much more than any other carrier. It now commands more than 18% of the U.S. market, up from 11% the previous year, and there is a chance that it will surpass Sprint in the next year or two. While T-Mobile assures investors (and its customers) that it has the capacity necessary to meet demand from its new subscribers, some analysts are concerned, which is why success in the AWS-3 Auction, as well as the 2016 Incentive Auction, will be of paramount importance to T-Mobile in reaching its stated goal of providing service to 300 million POPs by January 2016. This will most likely mean equipment upgrades (additional antennas) for property owners party to leases with T-Mobile. In addition to building out its network, T-Mobile must focus on optimizing capacity in key areas, such as Boston. In November 2014, it announced the launch of a “wideband” LTE service, which utilizes a 40 MHz spectrum band (double the original 20MHz), allowing for more traffic to be handled efficiently at any given time. To date, T-Mobile’s “wideband” LTE is available in 21 cities. It has even begun to boast “fastest speeds” in some cities, which is possibly correct, given that T-Mobile currently has half the number of customers accessing the same quality of network as Verizon and AT&T do. T-Mobile will certainly need to stay on top of its game, but from the looks of it, we believe that it has the resources and initiative to do so. Additionally, T-Mobile seems to be ahead of the pack regarding some capacity issues related to what is known in the industry as “cell site densification.” “We’re dense already,” says T-Mobile’s CFO Braxton Carter. The reason? T-Mobile, unlike AT&T, Verizon and Sprint, began its network build with mostly medium-frequency (mid-band) spectrum (unlike the 700 MHz low-band spectrum that AT&T and Verizon started with). While T-Mobile does have some DAS and small cells in place, it’s been made clear that their strategy is to improve coverage in rural areas with their newly acquired low-band spectrum.

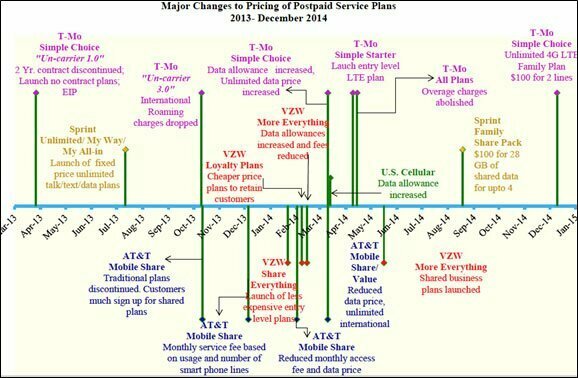

T-Mobile’s popular “Un-carrier” market pitch has resulted in Verizon, AT&T and Sprint falling over each other to cut prices to keep its customers happy. Doing so while managing stakeholder concerns is quite the balancing act. Carriers in general are presenting so many different plans that customers are having difficulty keeping up. In addition to price-cutting, carriers have had to increase data buckets for customers, and add new features like roll-over data, international text messaging and cloud storage allowances. These innovations have yielded two significant results: First, cellular data networks for all the carriers must be robust to handle capacity demand; and second, AT&T and Verizon must meet the expectations of their customers who anticipate a superior network, which means they cannot slack on rolling out network upgrades – or at least they cannot appear to.

5. Middle-band Spectrum Paid for and Ready to Use

Successful build-out of a nationwide wireless network requires a range of frequencies. Low frequency spectrum, which travels long distances and easily penetrates walls, is good for rural areas. High-frequency spectrum offers wireless carriers raw bandwidth that can be used in populated areas requiring fast data solutions, such as streaming video to phones. AWS-3 is middle-band spectrum and has some of the advantages of each.

After more than two months and 340 rounds of bidding, auction participants have paid just under $44.9 billion for the sought after AWS-3 mid-frequency spectrum. The final results have yet to be disclosed, but we can presume that both AT&T and Verizon bid heavily and acquired a number of new licenses. The total paid to Uncle Sam was over double what was originally expected. Most industry analysts assume that the AWS-3 band will be used to augment existing networks by increasing capacity. For instance, Verizon and AT&T have both successfully completed their 4G LTE upgrades, and provide service to over 300 million POPs nationwide (while T-Mobile states its build-out will be complete in 2015), but this doesn’t mean that all of their customers enjoy stellar service. In other words, while we can say on one hand that wireless coverage in most U.S. cities has reached a saturation point, high demand requires that network be augmented to provide greater capacity.

In December 2014, the NAB (National Association of Broadcasters) took the FCC to court over its proposed rules for its upcoming incentive auction of 600 MHz, low-frequency spectrum (currently used for broadcast TV). This delay is not good news for #3 and #4 wireless carriers, Sprint and T-Mobile, who need more low-band spectrum to compete with AT&T and Verizon. T-Mobile owns 6 MHz of low-band spectrum, while Sprint doesn’t have any!

The Incentive Auction will reserve 30 MHz of the best spectrum for “smaller” wireless carriers and new market entrants, which effectively means everyone but Verizon and AT&T. Once the spectrum is freed up, more towers will be built and existing towers upgraded with newer technology, which is the intended goal – not just to increase data speeds for customers with wireless devices, but also to energize the economy itself. This strategy, in combination with rules that will give new entrants discounts, could potentially create opportunities for competition in the wireless space. T-Mobile, however, has argued that if only 30 MHz is reserved, Verizon and AT&T will buy up and split all the rest, and suggests that the FCC must set aside more if competition is really the goal. Because the proposed methodology is so complex and details are still pending, the procedure for the Incentive Auction is still open for comment, and will remain so until late February 2015.

Regardless of what frequency the RF spectrum is, the purchase of spectrum licenses does come with responsibilities. For instance, every buyer is required to provide a reliable signal and service offering to at least 40% of the population in each market within six years, rising to 75% of the population by the end of the 12-year license term. If they do not accomplish a successful build-out within the time frame, they will have to forfeit their spectrum.

So what does this mean for landowners who are party to leases with any of the Big Four carriers? While the FCC doesn’t release specifics on who the big winners were, we can make some presumptions:

- Sprint already owns mid-frequency spectrum (in fact, that’s the only spectrum it owns), so it sat out this auction, in favor of waiting for the 2016 Incentive Auction, during which it hopes to acquire the low-frequency spectrum that it needs for rural builds. At the end of the day, we don’t expect to see much activity from Sprint – except in a few very populous and dense markets, where it will use its PCS (1900 MHz) spectrum to add capacity to its existing network.

- T-Mobile does need more AWS spectrum in order to cover approximately 1/3 of the country that is currently uncovered. If it did, in fact, score the winning bid, we can expect to see new cell site builds and improved coverage for customers.

- AT&T and Verizon will use their winnings to fortify their existing networks by adding small cells, and rooftop cell sites in densely populated areas, as well as some new site builds. Landowners who are currently party to cell site leases with AT&T can also expect to see requests for equipment modifications and additional ground space leases.

One thing is for sure, we can expect to see equipment upgrades across the board, for each of the Big Four carriers, which could mean additional compensation for property owners engaged in cellular leases.