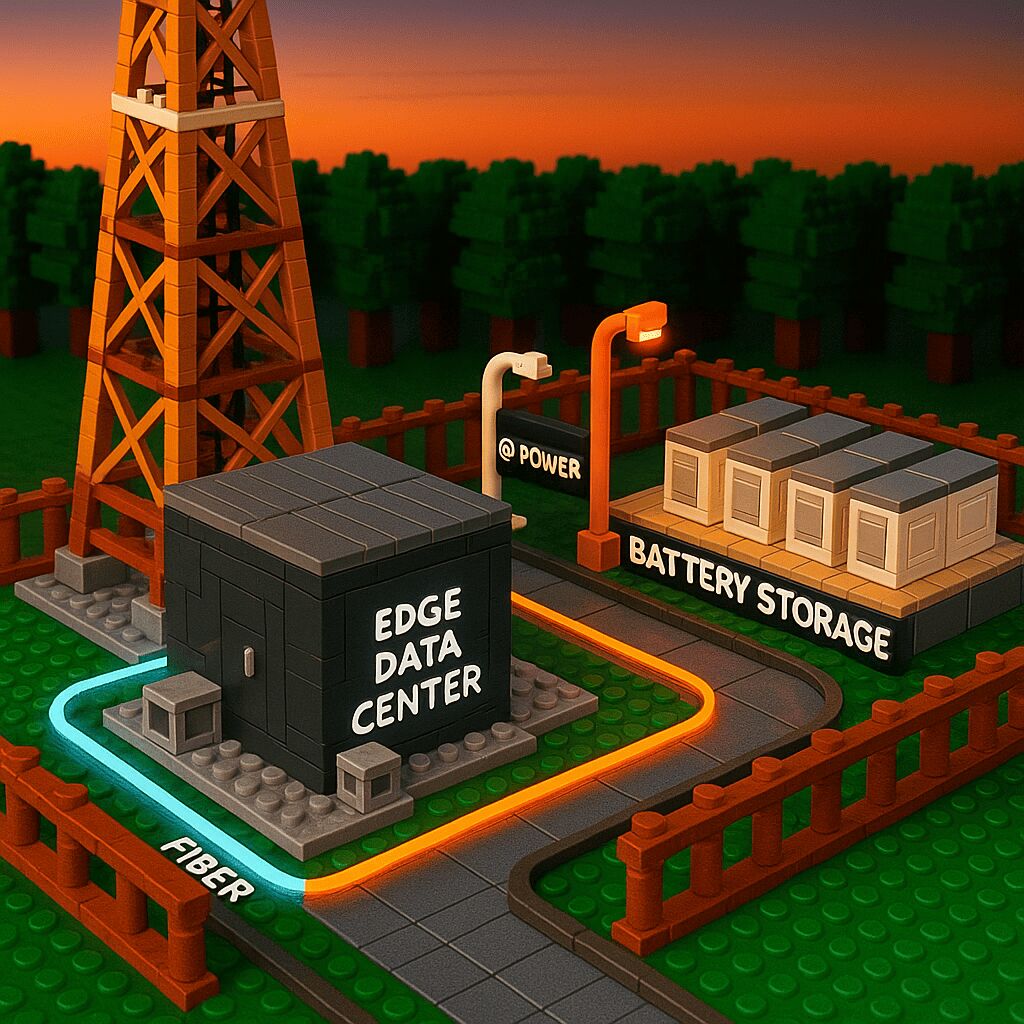

Over the last decade, we’ve heard plenty of talk about how cell tower sites would be perfect locations for edge data centers. The logic seemed sound: tower sites are already connected to power and fiber, they’re secure, and they’re spread out across the country. Put edge compute at the base of the towers, the argument went, and you could serve low-latency applications like streaming, IoT, or AI inference directly to nearby users.

It was a compelling vision, and companies like Vapor.io jumped in early, promising a distributed network of micro data centers tied to towers. But the reality hasn’t matched the hype. Capital costs were high, demand was inconsistent, and many sites just weren’t well suited for this type of infrastructure. 5G didn’t lead to the explosion of data use as the carriers hoped. By our own rough estimate, there may be only 30 to 50 true edge data centers at tower sites in the U.S. today. The rest of the industry has quietly shifted to a more targeted approach.

Why Tower Sites Look Good on Paper

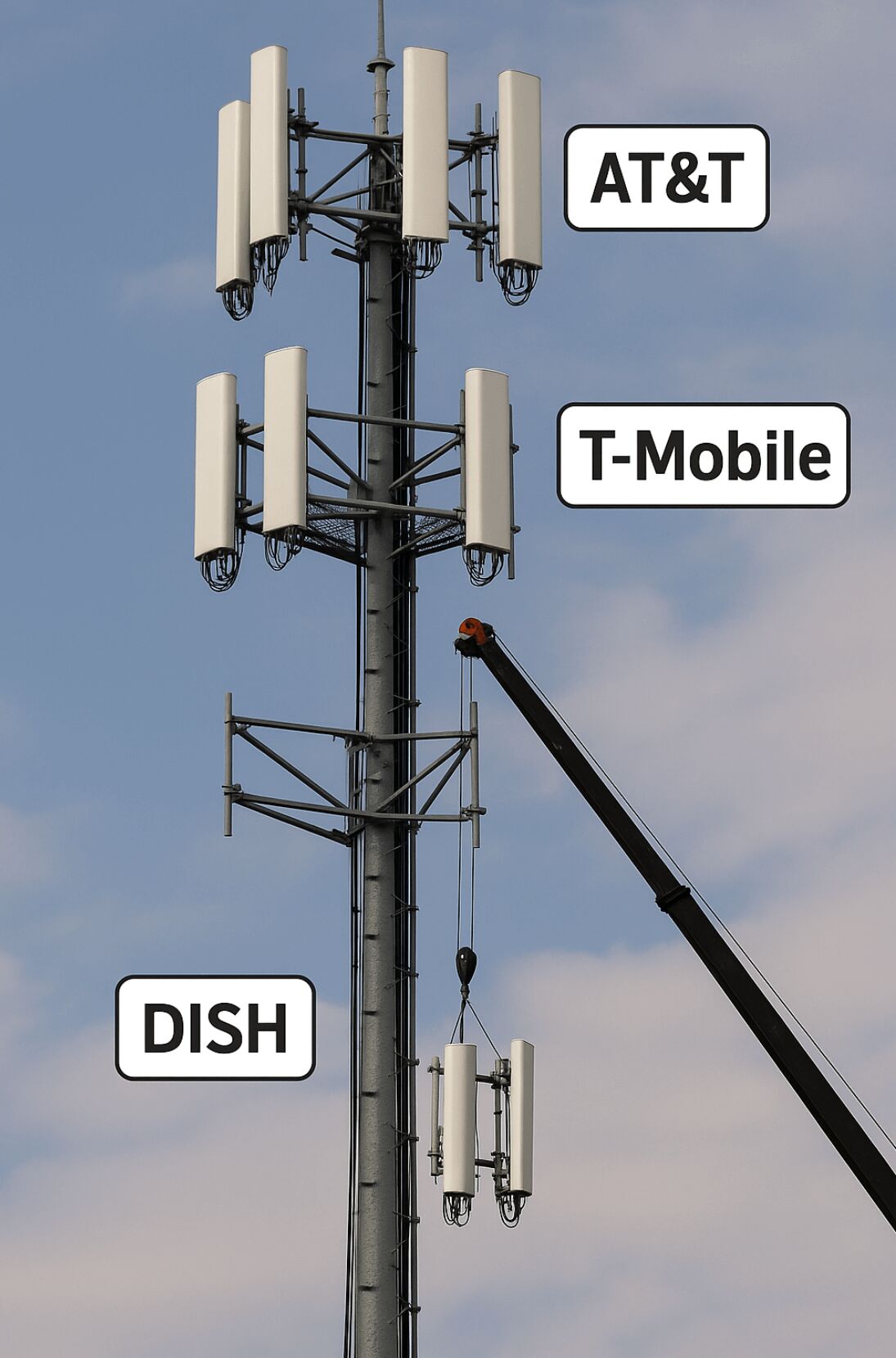

It’s not hard to see why tower sites initially seemed like natural homes for edge deployments. Their locations are often close to the end users who need low-latency connections. Many already have fiber backhaul in place. They’re powered, fenced, and built to handle telecom gear. And in some jurisdictions, they come with zoning or permitting advantages that make them easier to work with than a greenfield build.

But three factors have proven to be the real gatekeepers: space, power and fiber capacity. Without enough of each, edge computing simply isn’t viable. That’s why much of the edge discussion has historically stalled—many tower sites can’t deliver the space and the kind of power or bandwidth required for high-density compute. The industry was hopeful that smaller edge facilities could fit in smaller compounds- but there simply isn’t the need.

The good news is that this is changing, at least in part. The ongoing push to upgrade wireless backhaul means more cell sites are being fed with 10G fiber, which opens the door to supporting heavier workloads. And certain sites—especially larger broadcast tower parcels—already have substantial power infrastructure in place. For those rare locations, the barriers are lower, and the economics start to look more attractive.

ATC’s High Bar

Recently, American Tower spelled out what they consider the minimum requirements for a viable edge site: at least 2.5 acres, flat land, outside a floodplain, with access to fiber and sufficient power. That’s not a typo—2.5 acres. Most cell tower sites are less than a quarter of an acre. ATC’s definition points to something much larger than the micro-edge facilities many in the industry had envisioned. It’s more in line with what I would call a metro-edge or aggregation sites.

From what I can tell, ATC is using its successful Raleigh facility as the model here. It’s a proven concept, but it’s not a one-size-fits-all approach. Very few tower sites meet these physical criteria, and when you layer on the need for a strong business case in the surrounding market, the number gets even smaller.

A Market Measured in Single Digits

The more important question isn’t just how many sites meet these physical standards, but how many do so and are located in urban or metro-adjacent areas where low-latency demand is highest. If you apply both filters—site suitability and location demand—the pool may shrink to 500 to 1,000 of all U.S. towers.

Many of those qualifying sites are in the hands of tower companies that own legacy broadcast tower portfolios, which often include larger parcels and heavier utility service. For everyone else, the acreage and location combination are rare.

And here’s another wrinkle: in many cases, what’s stopping an edge provider or MNO from simply building their own facility instead of leasing from a tower company? If they already own land and have utilities in place, the economics may tilt toward building from scratch. Leasing space at a tower site only makes sense if the location offers something uniquely valuable, such as prime urban real estate, ready-to-use secure infrastructure, speed to market, or a synergy with existing wireless equipment.

How Tower Companies Are Planning Ahead

Some tower companies are thinking long term. They’re adding lease language that reserves the right to use the property for alternative purposes, like edge compute or battery storage. This gives them the option to act quickly if the right customer and economics come along, without having to renegotiate with the landowner.

In rare cases, we’re also starting to see tower buyers factor the possibility of edge or battery deployments into their due diligence and financial modeling of potential acquisitions. But those are exceptions—usually involving unique sites that have the right size, location, infrastructure, and market demand all in one package.

What It Means for Ground Leases

For most landowners, the potential for edge data centers or battery storage won’t change much in today’s lease negotiations. Given how novel this all is, until edge compute or battery power storage is installed at the site, it won’t factor into a tower owner’s consideration when renewing a lease.

There are rare situations where it matters—typically large parcels in urban markets or sites already on the shortlist for near-term deployment. But for the vast majority of sites, these future possibilities are just that: possibilities.

Closing Thoughts

Even the more bullish voices in the industry, like Marc Ganzi of DigitalBridge, see this as a long-term play—a decade-long transition from today’s centralized AI models to micro-edge AI at the tower site. Space, location, power, and fiber will dictate which sites are viable, and while upgrades are happening, the addressable market will remain small for the foreseeable future but could accelerate over time.

ATC’s high bar shows that this is a selective, high-value opportunity. The winners will be the portfolios that combine site suitability, available power, fiber capacity, and market demand—whether the eventual play is racks of AI inference servers or megawatts of battery backup. For everyone else, edge will remain more of a “someday” opportunity than a current revenue stream.