American Tower Corporation

American Tower Buys Global Tower Partners

American Tower Corporation Buys Global Tower Partners For $4.8 Billion

NEWS

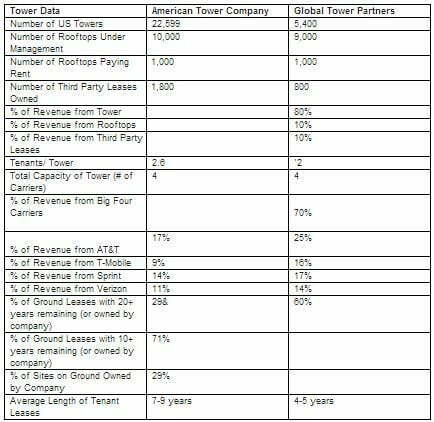

On September 6, 2013, American Tower Corporation (AMT) announced the acquisition of Global Tower Partners. American Tower Corporation, as of the end of the 2nd Quarter of 2013, owned 22,599 towers in the US and managed approximately 9 – 10,000 rooftops. The acquisition adds approximately 5,400 towers in the US, along with 9,000 rooftops under management. Furthermore, the portfolio includes 800 “domestic property interests,” which is akin to leases that GTP bought in bulk from lease buyout companies. American Tower paid $4.8 billion for the portfolio which equates to around 13 times the net revenue. Below is data that we pulled from the conference call announcing the transaction.

As we have suggested in other articles, the purchase multiples for acquiring cell towers are at a high point, so Global Tower Partners sold at an excellent time (in our opinion, their timing could not have been better.) As for American Tower, time will tell whether the acquisition of this portfolio will be a good one. American Tower points out during the conference call announcing this transaction that the towers are younger, on average, and the tenants per tower is lower. American Tower suggest that these towers should experience greater growth because they are younger and have a high percentage of unused capacity.

Contact Us

For landowners with American Tower leases, little will change. There is nominal risk that American Tower will start terminating their own ground leases due to nearby Global Tower Partners towers. Existing offers/deals to buy and extend leases will continue as planned.

For landowners with Global Tower Partners leases, there is upside to this transaction. First, like above, there is little risk that American Tower will terminate Global Tower Partners leases due to there being existing American Tower sites nearby, with some rare exceptions where they can consolidate two nearby towers. Secondly, and more importantly, American Tower has clearly been more aggressive in the past few years with acquiring long term easements under their leases or entering into long term extensions to extend their leases prior to expiration.

Landowners with Global Tower Partners tower leases will find that they will receive better offers in the future. It might take some time for the acquisition to occur, but we would advise you to wait if you are contemplating a lease extension or lease buyout on your Global Tower Partners ground lease. Please see American Tower Corporation Lease Expirations and Extensions for more details on their lease extensions program.

If you have any questions about this proposed acquisition, please don’t hesitate to contact us.

Insider tips

Tower companies often prefer to purchase leases outright in order to further diversify their portfolio of assets; however, they are not the only companies out there who are interested in buying cellular leases. Buyout companies do it for profit alone. The motivation of the buyer may or may not be of interest to you, but it will likely affect their final offer.

When renegotiating leases, you should first check the expiration date (which is not the same as the renewal date). If you have more than five years remaining on your lease, it’s probably best to leave well enough alone. Why? Because leases are typically valued higher the closer they are to expiration.