Steel in the Air’s 2024 Cell Tower Industry Predictions

As we do every year, we like to make predictions about the year ahead. (It’s near the end of March- so you can see we were a bit behind – perhaps because of all the early activity in 2024. 😊) And without further ado:

1. 2024 will be slightly better than 2023, especially the last half. As wireless service providers (WSPs) reduced their capital expenditures and slowed down modification and stopped building new cell sites in the latter half of 2023, the industry slowed down. Going forward, this year will be better than the second half of 2023 but still be reduced compared to the full year 2022 and the first half of 2023. Why? Because the WSPs are rationalizing their 5G spending. The secret is out: 5G isn’t generating a significant amount of new revenue for the WSPs. While there are operating efficiencies to be gained from 5G, there aren’t any killer use cases that are driving growth. How do I know- just look at the carrier’s recent commercials and how the focus isn’t on 5G.

2. WSPs will increase the number of new site builds (NSBs) in 2024 as compared to 2023. The WSPs focused on modifying existing tower sites to add 5G capabilities in 2022-2023. Going forward though, we expect to see a blend of modification activity (more later in this post) and new site builds. Already this year, we are seeing a lot more inquiries from landowners about new proposed tower leases than at this same time last year.

3. WSPs aren’t building that many towers themselves. Instead, there is a clear push to let private tower companies build the towers under what is known as the build-to-suit model. The WSPs have done a great job of letting the private tower companies compete for the limited number of build-to-suit opportunities. As some private tower companies become desperate to put committed capital to work, they are agreeing to ever worsening terms and conditions in their master lease agreements. The WSPs are attempting to insert the best negotiated terms from all their build to suit leases into a single “Frankenstein” template agreement. This leads to a race to the bottom for tower companies. And given the favorable terms in these build-to-suit master leases, it makes more sense for a wireless carrier to let a tower company take the risk and incur the cost of tower development.

4. Dish. I wish I had a good prediction about DISH- but the reality is that I don’t think anyone does, not even DISH. Things don’t look good for DISH. They passed on purchasing 800MHz spectrum from T-Mobile even though Charlie Ergen loves spectrum. They aren’t actively building in preparation for their June 2025 deadline and their cost of capital is horrific. They are losing subscribers quarter after quarter and there is virtually no marketing of the DISH network for more subscribers. They obviously have significant cash issues. Gun to my head, my prediction is that in 4 years, DISH won’t own wireless spectrum or a network.

4. Tower companies will pursue ways to replace the lost revenue from their tenant leases. One way that we addressed earlier this year is to seek prepaid leases whereby the landowner is offered a lump sum for a lease instead of a regular monthly lease payment. Another is to squeeze contractors for cheaper pricing. Tower companies like this model because landowners may

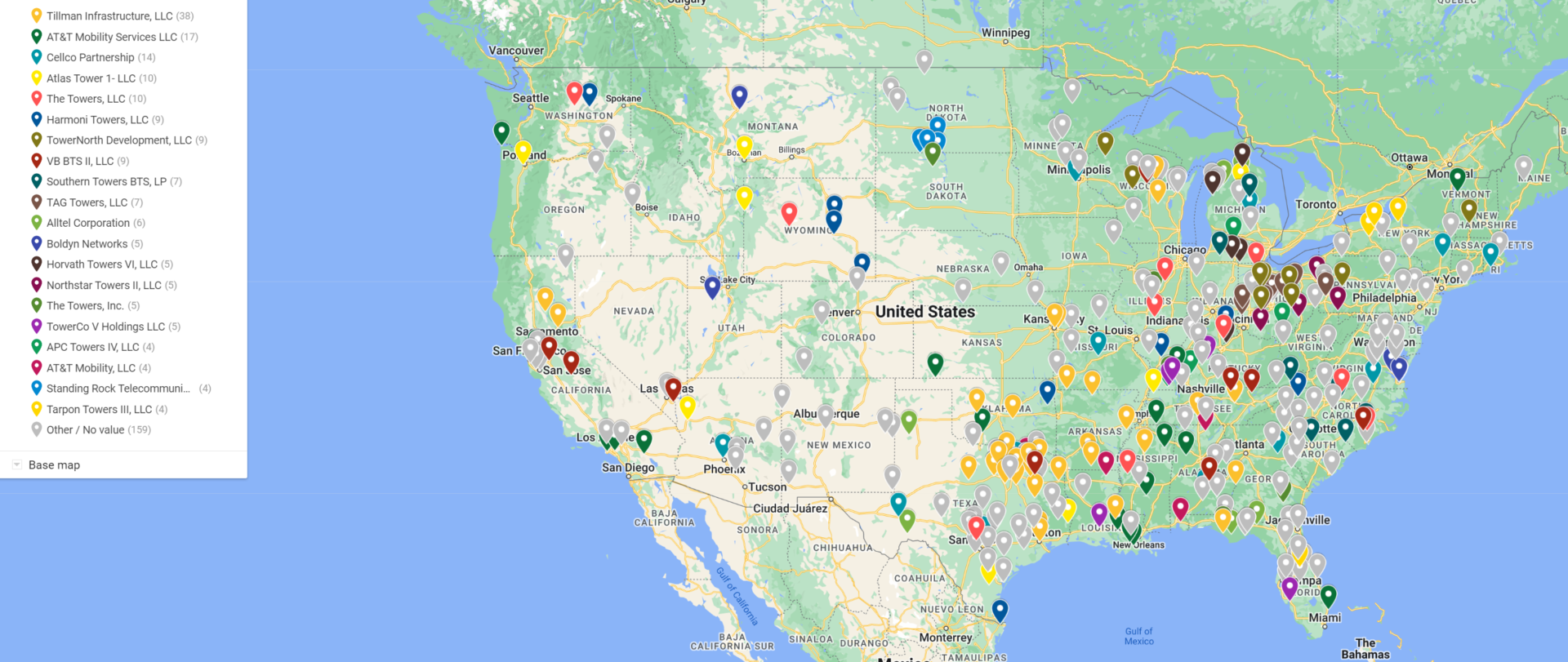

5. WSPs continue to look for opportunities to relocate off towers where the tower owner is charging exorbitant rent. We have detailed this build-to-relocate model before – where companies like Tillman Infrastructure build towers near existing towers – particularly in rural areas with no zoning. Alternatively, we have observed more situations where a WSP moves from one tower to another existing tower nearby. Primarily this is happening with public tower company leases.

6. 2024 is the year where competition between the public tower companies will increase. We have seen more relocation of a carrier’s equipment from one public tower company tower to another tower company’s tower across the street in the last year than we saw in the last decade. (So as not to mislead- the numbers are still small.)

7. Competition between private tower companies will hit its peak. There is too much cheap capital and too many tower companies out there chasing too-few build-to-suit opportunities. Some tower companies will dial back their build plans whether they choose to or not, while others already are being more selective.

8. Transactions with public tower companies are and will take longer. Perhaps WSPs are experiencing similar issues as we are in terms of dealing with the public tower companies, but with recent staff layoffs, it just seems like everything takes longer to complete. Cell tower lease buyouts and lease extension/expirations take longer. Crown Castle for example reduced their lease extension/lease buyout team by 3/4s. Guess what takes longer now? Lest you think that this issue is solely that of public tower companies, there are some large private tower companies that simply ignore contractual deadlines – perhaps daring the landowner to evict them or terminate an agreement. The WSPs have been trying to push landowners to use landowner help desks (email submittals) with mixed results. Some issues are handled very quickly- but if the issue requires any nuance or is difficult, escalating to the right person can take forever. (HINT: if you are running into difficulties getting answers or resolution from a tower company or WSP help desk- be the squeaky wheel!) But on the positive side, these mistakes can benefit landowners with leases. For example, on multiple occasions over the last year, landowners were not contacted until the last minute to negotiate on expiring leases. Personally, we love these situations- as the tower company’s leverage in these negotiations lessens the closer the lease gets to expiration.

9. AI. The buzzword in the tower industry these days is AI, as it is in almost any industry. How will AI impact the tower industry? I expect to hear tower companies mention AI in every earnings call- but in a broad “AI will increase demand for edge computing” but without any actionable guidance on whether revenue will be increased. Where I expect the true impact of AI to be felt in the near term is in further staff reduction. There are some job functions at the carriers and tower companies that could quite candidly be handled by AI better and faster. Drafting and review of lease documents, review of plans and structural analyses, regulatory submittals, maintenance reviews, permitting submissions. Basically, anything that is repetitive and consistent. And in contemplating the landowner helpdesk of the future, I can already hear myself screaming at the computer- “live agent, live agent”.

10. Be prepared for an onslaught of solicitations regarding cell tower leases. The nature of AI (iteration and correction, repeat) will allow smaller number of personnel to contact more landowners. And because AI can handle significantly greater amounts of data and learn faster from iteration, I expect the number of requests to landowners regarding lease buyouts, lease extensions, and lease renegotiations to increase dramatically. Without guard rails, AI “agents” will pry and persist at trying to find every permutation of an approach to a landowner until they find the ones that work best. AI agents though will also make material misrepresentations on accident though, opening up the companies that use them to fraud in the inducement claims.

11. Private networking gets real. Rather than restate something that someone has already said better than I can- will like to this LinkedIn post from Michael Collado on the boondoggle that of private network forecasts by industry experts. The problem with the private networking industry is that there is an unreal amount of hype and documentation of use cases propagated by the OEMs and system integrators who expected more work out of private 5G/private networking. The reality is here: it’s still hard to have the WSPs connect to your private network unless you are a larger or must have venue or are willing to pay dearly to get it. That may be changing, but private networking remains just that for the most part- private. Just like the hype of 5G, the hype of private networks has dissipated somewhat too. Don’t take this forecast the wrong way- private networking will grow and be one of a few parts of a coverage/data toolkit for enterprises and venues. But not remotely close to the pie-in-the-sky estimates publicly put forth by some industry analysts or the OEMs/system integrators.

12. The economics of operating cell sites and towers are changing – slowly. While no technology (satellite or small cells) can replace cell towers in any material fashion, tower level economics are getting worse. It costs more to build towers; the tenants are trying to pay less while expecting more and they are more willing to relocate from overly expensive sites. Landowners and tower owners who rely solely upon what has worked in the past may receive termination notices they have never received in the past. At the risk of being self-serving, more now than ever, it pays to understand the overall market and the site-specific conditions of your lease or tower site. As they say, pigs get fed and hogs get slaughtered. Steel in the Air remains the best source of knowledgeable guidance in the industry, and we make sure you get today’s fair market value, not tomorrow’s termination letter. We welcome your calls and inquiries.

We hope you have found something of value in our predictions. There are some that we hope we are completely wrong about (DISH for example). We would love to hear your thoughts and feedback about our predictions or ones you think we have missed5