Search

Examining the Objectivity of Surveys/Polls for Private Networking

In recent years, there has been a proliferation of studies commissioned by system integrators and OEM vendors claiming that in-building wireless coverage is insufficient and

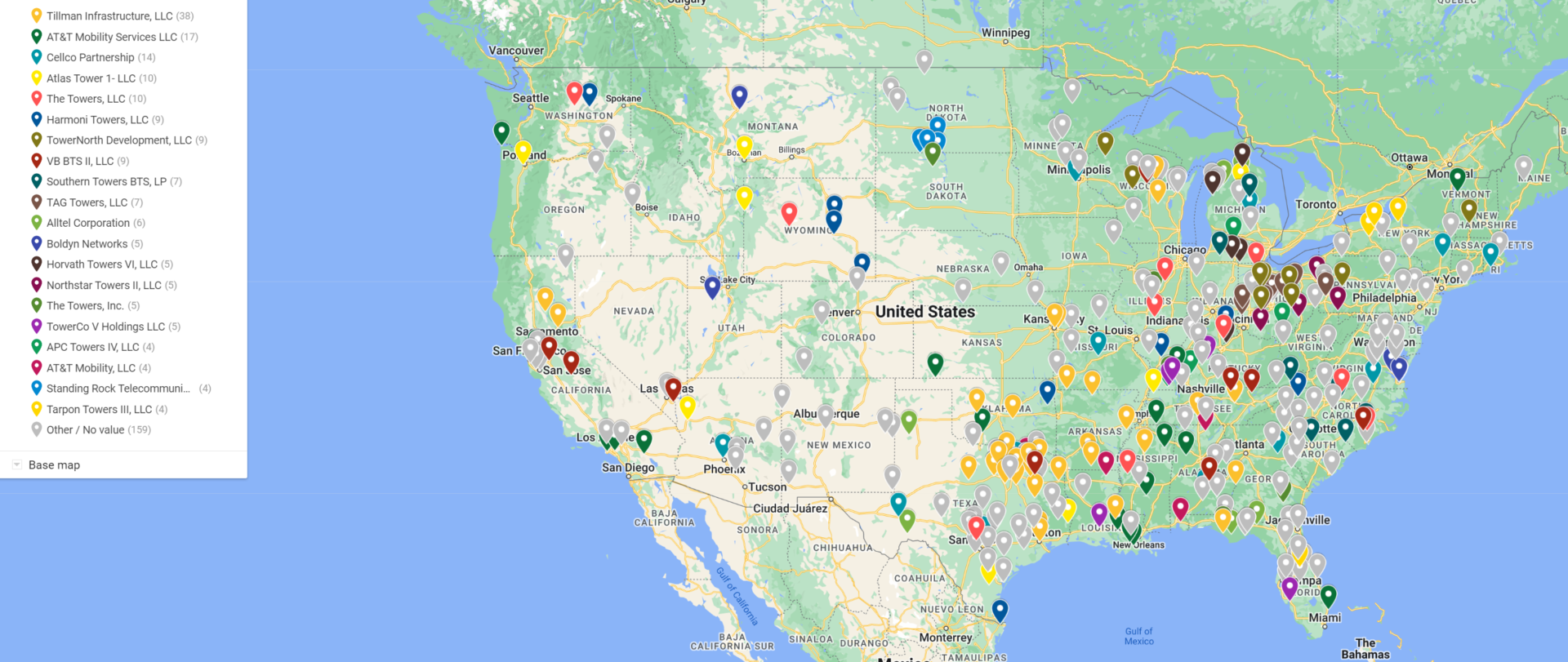

Which US Tower Companies Were Most Active in Jan. 2024?

We examined applications for environmental notice to the FCC for the last month. Here are the companies that have been most active in submitting

Will Satellites Replace Cell Towers? Unpacking Black Dot’s Claims.

Recently, Black Dot (a cell tower lease optimization company) has been contacting landowners with a new slick produced video where they claim that cell towers

PREPAID CELL TOWER LEASES AND EASEMENTS – WHAT TO WATCH OUT FOR

In recent years, there has been a significant increase in offers to landowners to “pre-pay” cell tower leases with a single lump sum, instead of regular

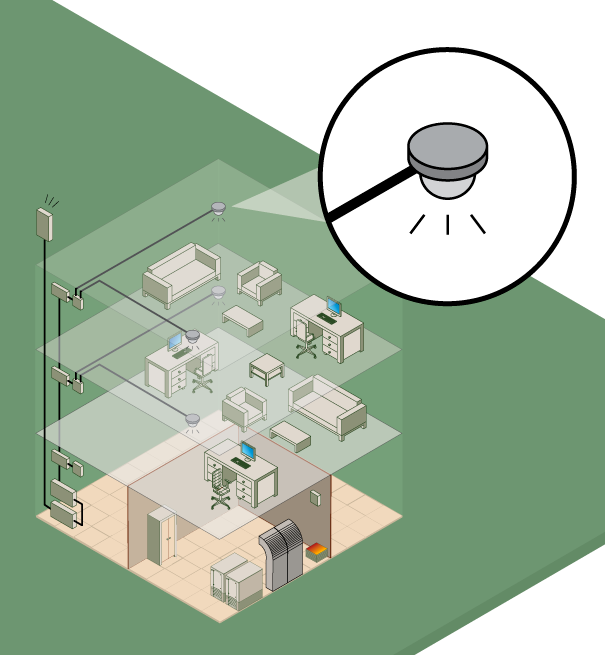

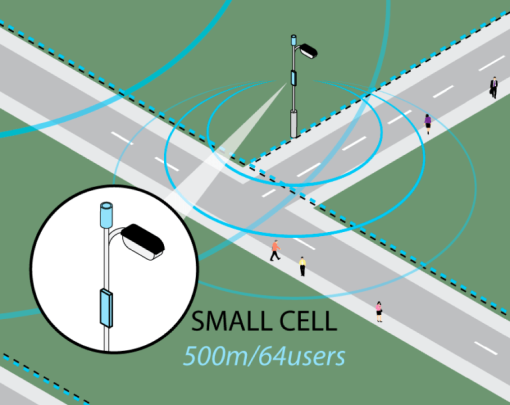

Number of Cell Towers and Small Cells in the United States in 2023

The Wireless Infrastructure Association recently issued a white paper that included their estimates of the number of macrocells, cell towers, and small cells in the

The Early Days of the Cell Tower Lease Buyout Business

During my early days in the wireless industry, while employed by a tower company, I worked alongside a site acquisition vendor named Nape Touchstone. Eventually,

STEEL IN THE AIR’S 2023 PREDICTIONS FOR CELL TOWER LEASING AND VALUATION

2022 turned out to be a strong year for wireless activity. Wireless capital expenditures were the highest in the last 5 years. Carrier activity focused

FCC Orders Landowner to Remove Abandoned Tower

In a surprise ruling, the FCC determined that a landowner was responsible for removing a 375’ guyed tower on their property after the broadcaster that

2024 Rural Cell Tower Lease Update – Steel in the Air

As we enter 2024, we thought it might be helpful to summarize what we have been seeing with new leases and existing leases in rural

Update on 2022 in Wireless- analysis and expectations.

Now that we have passed the midpoint of 2023, we thought it might be helpful to share our observations from the first half of 2023

- Best Practices for Landowners, Government Entities & Venue Owners ·

Examining the Objectivity of Surveys/Polls for Private Networking

- February 27, 2024·

- 0 Comments·

- Cell Tower and Cell Site Development ·

Which US Tower Companies Were Most Active in Jan. 2024?

- February 17, 2024·

- 7 Comments·

- 5G ·

Will Satellites Replace Cell Towers? Unpacking Black Dot’s Claims.

- February 11, 2024·

- 6 Comments·

- Cell Tower and Cell Site Development ·

PREPAID CELL TOWER LEASES AND EASEMENTS – WHAT TO WATCH OUT FOR

- December 9, 2023·

- 0 Comments·

- Uncategorized ·

Number of Cell Towers and Small Cells in the United States in 2023

- March 22, 2023·

- 0 Comments·

- Cell Tower Valuation and Brokerage ·

The Early Days of the Cell Tower Lease Buyout Business

- January 20, 2023·

- 1 Comments·

- 5G ·

STEEL IN THE AIR’S 2023 PREDICTIONS FOR CELL TOWER LEASING AND VALUATION

- January 13, 2023·

- 5 Comments·

- Best Practices for Landowners, Government Entities & Venue Owners ·

FCC Orders Landowner to Remove Abandoned Tower

- December 9, 2022·

- 0 Comments·

- Cell Tower Builds & Wireless Technology ·

2024 Rural Cell Tower Lease Update – Steel in the Air

- December 1, 2022·

- 2 Comments·

Update on 2022 in Wireless- analysis and expectations.

- August 23, 2022·

- 4 Comments·