Search

Biggest Issues for Small Cells: Leases and Backhaul

Alcatel-Lucent has created a database of 600,000 potential small cell sites. They have coordinated with building owners, tower companies, cable companies, outdoor advertising providers, systems

Global Tower Partners is Up for Sale

While we had heard about this previously, the news was not public until yesterday. Reuters is reporting that MacQuarie has put Global Tower Partners

Sprint LTE Upgrades

Sprint in their 2013 2nd Quarter earnings calls had some interesting things to say:

Leap Wireless News: AT&T Wireless Acquires Leap Wireless (Cricket)

What does this wireless company merger mean to leaseholders? On July 12, 2013, AT&T announced plans to acquire LEAP Wireless (Cricket). AT&T will acquire LEAP for

The Cell Tower Lease Buyout Guide – A New Website for Landowners

Ken Schmidt, President of Steel in the Air, Inc., has launched a new website www.celltowerleasebuyout.com – intent on providing landowners with decisive answers to timely questions involving

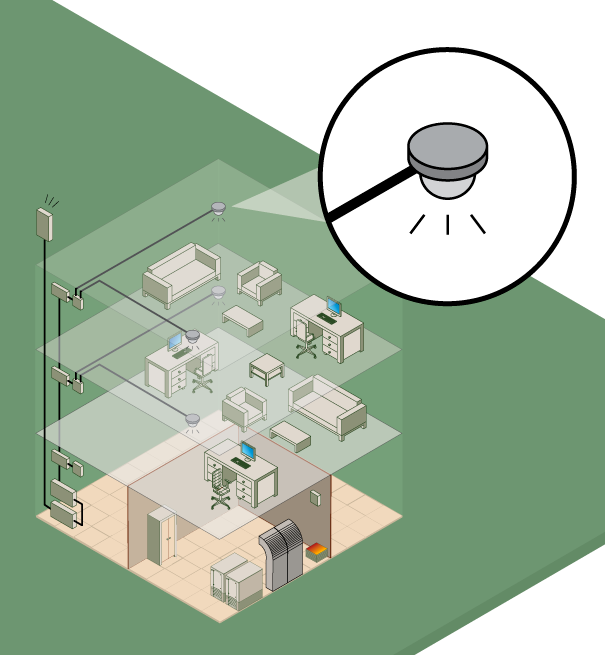

The Hidden Pitfalls Behind Promises to Manage Rooftops or In-Building DAS

We see a current trend where large property owners (storage facilities, industrial parks, malls and housing complexes, among others) are being contacted with offers to

Fiber-Optic Consent Requests

Cell tower landowners and building owners across the country are being besieged by requests from wireless carriers to add fiber-optic communications to their cell sites.

Cell Site Lease Offers from the Carriers: Average Lease Rate Examined

Which carrier pays the most for their leases on a general basis? To answer this question, Steel in the Air turned to our cell site

Consent Requests for Fiber Optic Cable

Building owners and tower ground leaseholders nationwide are being contacted on a regular basis by the wireless carriers and tower companies who occupy their property

The Fate of Clearwire’s Existing Long Term Evolution (LTE) Network Clearwire LTE Plans

Clearwire Corporation (NASDAQ CLWR) is a leading provider of fourth generation, or 4G, wireless broadband services. Clearwire owns the rights to radio frequency spectrum in

Biggest Issues for Small Cells: Leases and Backhaul

- December 4, 2013·

- 0 Comments·

Global Tower Partners is Up for Sale

- August 7, 2013·

- 0 Comments·

Sprint LTE Upgrades

- August 4, 2013·

- 0 Comments·

Leap Wireless News: AT&T Wireless Acquires Leap Wireless (Cricket)

- August 4, 2013·

- 0 Comments·

The Cell Tower Lease Buyout Guide – A New Website for Landowners

- August 3, 2013·

- 0 Comments·

The Hidden Pitfalls Behind Promises to Manage Rooftops or In-Building DAS

- August 2, 2013·

- 0 Comments·

Fiber-Optic Consent Requests

- August 1, 2013·

- 0 Comments·

Cell Site Lease Offers from the Carriers: Average Lease Rate Examined

- July 24, 2013·

- 1 Comments·

Consent Requests for Fiber Optic Cable

- July 14, 2013·

- 4 Comments·

The Fate of Clearwire’s Existing Long Term Evolution (LTE) Network Clearwire LTE Plans

- May 28, 2013·

- 2 Comments·