Search

Q1 2022 State of the Industry Update from Ken

For anyone hoping that 2022 would slow down from 2021, that will not happen. We enjoyed a slight lull in activity in January, only to

Cell Tower Lease Revenue Share Hijinks

A client of ours has a ground lease with one of the Big three public tower companies. Instead of rent, the landowner gets a straight

5G Site Marketing: Scam or Opportunity?

One of the more disturbing trends in 2021 and early 2022 is the rise of the “5G site marketing companies.” Over the past year, we

Verizon Finds Landowners Don’t Like ROFR Clauses- So They Rebrand Them.

The wireless carriers are actively seeking to add right-of-first-refusal clauses (ROFR) to their new and extended cell site lease agreements. Verizon includes standard ROFR language

Our 2022 Predictions for the Wireless Industry

Steel in the Air’s 2022 Predictions for Cell Tower Leasing and Valuation While 2021 certainly impacted many industries negatively, the wireless industry wasn’t one of

Hey Wireless Industry- This is the Right Way to Request a Cell Tower Modification

We regularly review requests from carriers for cell tower lease modifications on our client’s structures and towers. One of the hurdles we find in doing so is

When is a Building Permit Required for Equipment Changes?

When is a Building Permit Required for Equipment Changes? In recent years, our clients have experienced a number of requests for modifications to existing cell

What’s Happening with Cell Tower Leases in 2021?

Earlier this month, we did our Wireless Industry Forecasts for 2021 webinar, which is available for viewing here, along with some other webinars about the

Getting What You Deserve from your Cell Tower Lease!

Getting What You Deserve from your Cell Tower Lease! Missing Income: Electric and tax reimbursement clauses in cell site leases. In the standard cell tower

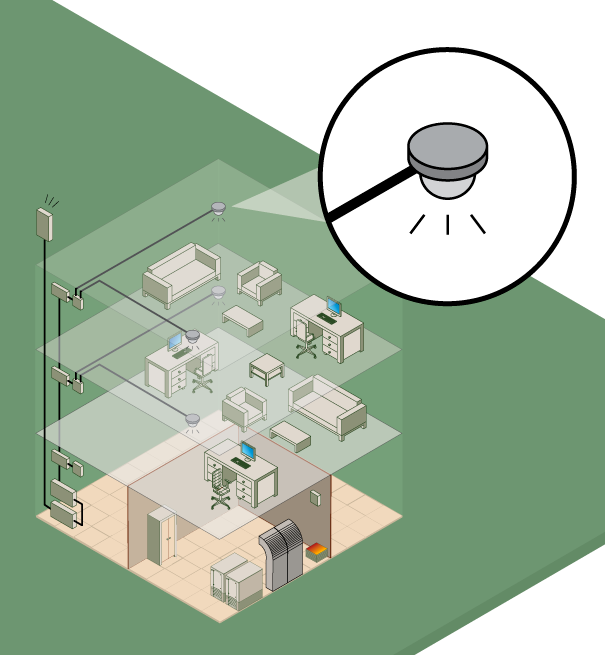

Online Training On RF Radiation That Everyone Can Understand

Radio Frequency energy or RF has been in the news and is not likely to go away. Between 5G and COVID-19 conspiracies and more antennas

Q1 2022 State of the Industry Update from Ken

- March 30, 2022·

- 1 Comments·

Cell Tower Lease Revenue Share Hijinks

- March 24, 2022·

- 4 Comments·

- Cell Tower Companies in the News ·

5G Site Marketing: Scam or Opportunity?

- March 23, 2022·

- 0 Comments·

Verizon Finds Landowners Don’t Like ROFR Clauses- So They Rebrand Them.

- February 8, 2022·

- 2 Comments·

- Cell Tower and Cell Site Development ·

Our 2022 Predictions for the Wireless Industry

- January 18, 2022·

- 2 Comments·

- Equipment Modifications & Lease Renegotiations ·

Hey Wireless Industry- This is the Right Way to Request a Cell Tower Modification

- January 8, 2022·

- 0 Comments·

When is a Building Permit Required for Equipment Changes?

- February 6, 2021·

- 6 Comments·

- Cell Tower and Cell Site Development ·

What’s Happening with Cell Tower Leases in 2021?

- January 21, 2021·

- 2 Comments·

- Lease Rates and Lease Valuation ·

Getting What You Deserve from your Cell Tower Lease!

- November 23, 2020·

- 0 Comments·

Online Training On RF Radiation That Everyone Can Understand

- July 29, 2020·

- 2 Comments·