Search

Rural Deployment is all the Rage this Coming Year. Here’s Why

In recent months, there have been a number of merger rumors and announcements between various wired and wireless telecom companies. AT&T announced its proposed acquisition

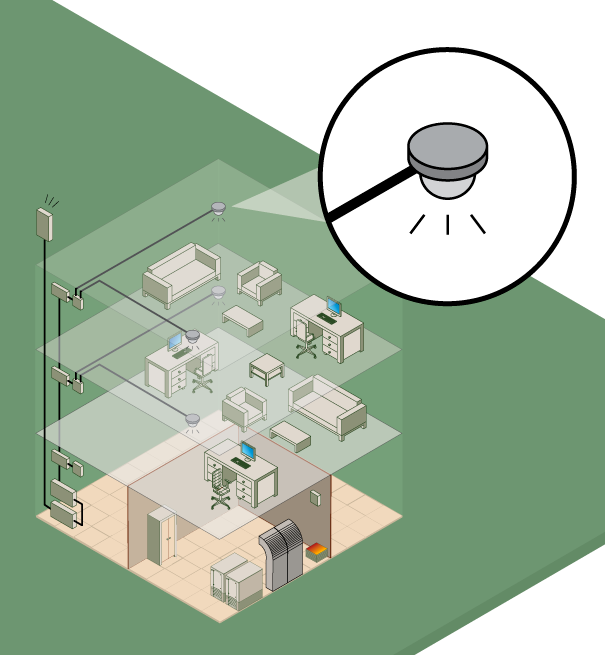

Smart Cell Site Deployment Can Benefit the Hotel Industry – Here’s How.

In 2012, wireless subscriber use surpassed 100% – meaning that the average person in the US had more than one wireless device – and this

Supreme Court to Determine Process Regarding Municipalities Approving Tower Builds

On May 5th, he U.S. Supreme Court agreed to hear a case between T-Mobile and the city of Roswell, GA during its Fall term, which

Verizon’s Acquisition of Cincinnati Bell’s Spectrum and Assets Will Result in the Termination of Cell Site Leases

Today, April 7, 2014, Verizon announced that it has finalized a deal with Cincinnati Bell wherein it will purchase all of Cincinnati Bell’s cellular assets

Steel in the Air, Inc.: A Look Back at Our First Decade

In 2004, when I started Steel in the Air, Inc., I believed there was an opportunity to assist landowners with making informed decisions about cell

Rebranding with a more visible and responsive online presence.

Steel in the Air is celebrating our tenth year anniversary this month with the launch of a new website – dedicated to the landowners and

A True Win-Win: The Warriors for Wireless Initiative

Molly Cooper began her career in the tower industry at the bottom, literally climbing her way to the top – sometimes as high as 1400

SITA Forecasts for 2014

In looking forward to 2014, I thought it might be helpful (and fun) to publish our top ten forecasts for the coming year. Wireless Spending

American Tower Lease Extensions – DELAYED!

A good portion of our business comes from landowners who have received offers to extend their leases from the large tower companies like Crown Castle

Tristar Investors Lawsuit Against American Tower Corporation

On Feb 16, 2012, Tristar Investors sued American Tower Corporation alleging that American Tower had violated the Lanham Act, unfairly competed, disparaged Tristar’s business, tortuously

Rural Deployment is all the Rage this Coming Year. Here’s Why

- June 6, 2014·

- 1 Comments·

Smart Cell Site Deployment Can Benefit the Hotel Industry – Here’s How.

- May 30, 2014·

- 0 Comments·

Supreme Court to Determine Process Regarding Municipalities Approving Tower Builds

- May 28, 2014·

- 0 Comments·

Verizon’s Acquisition of Cincinnati Bell’s Spectrum and Assets Will Result in the Termination of Cell Site Leases

- April 8, 2014·

- 0 Comments·

Steel in the Air, Inc.: A Look Back at Our First Decade

- January 24, 2014·

- 0 Comments·

Rebranding with a more visible and responsive online presence.

- January 24, 2014·

- 0 Comments·

A True Win-Win: The Warriors for Wireless Initiative

- January 24, 2014·

- 0 Comments·

SITA Forecasts for 2014

- January 24, 2014·

- 0 Comments·

American Tower Lease Extensions – DELAYED!

- December 4, 2013·

- 1 Comments·

Tristar Investors Lawsuit Against American Tower Corporation

- December 4, 2013·

- 0 Comments·